6 Financial Statements

Learning Objectives

- Distinguish between multiple-step and single-step income statements.

- Explain the computation and importance of gross profit.

- Distinguish between departmental and consolidated income statements.

- Identify and explain the sections of a classified balance sheet.

- Understand the relationship between the income statement and the balance sheet.

- Indicate the primary purpose of the statement of cash flows.

- Distinguish among operating, investing and financing activities.

Single-step and Multiple-step Income Statements

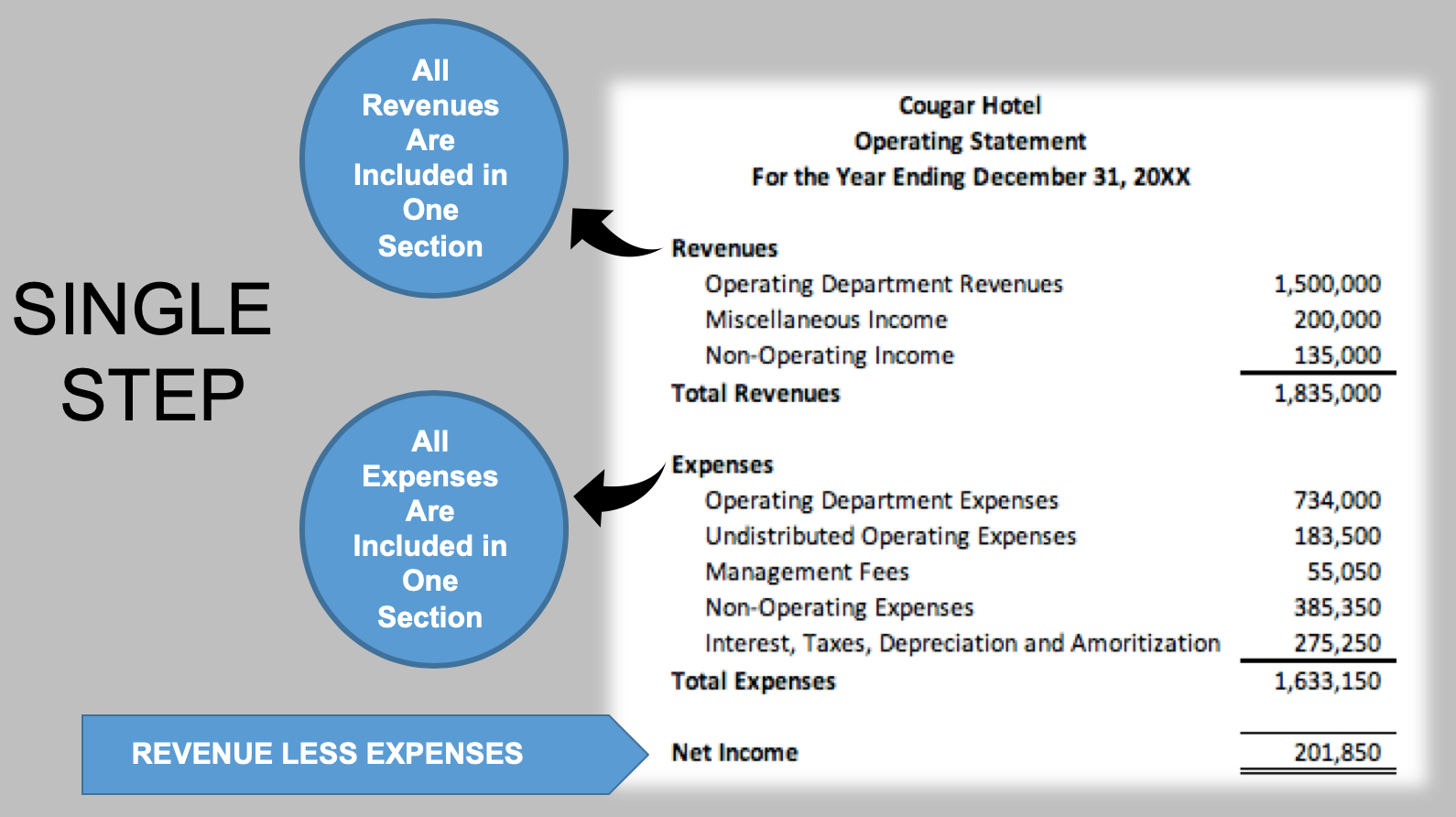

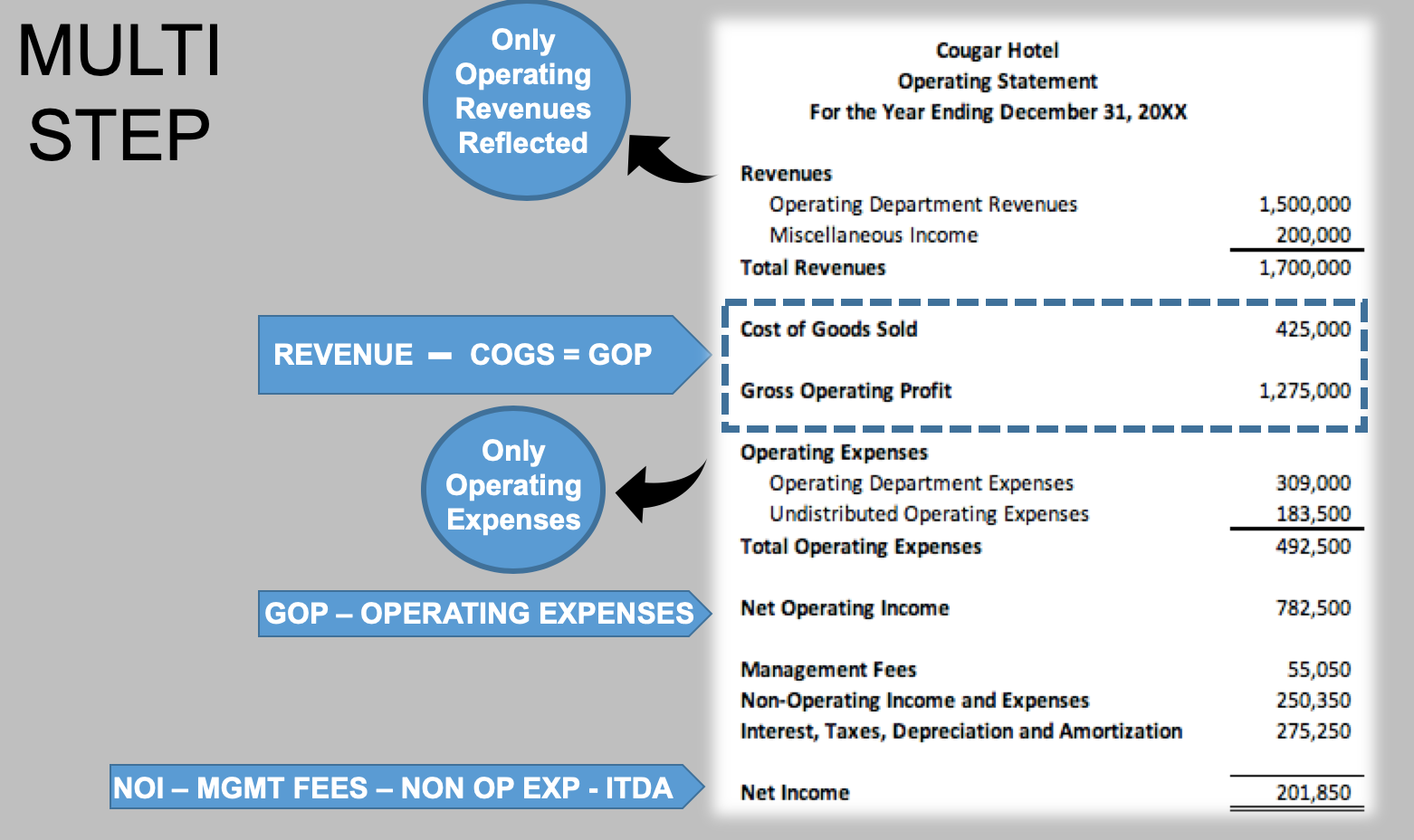

In previous modules, we learned that the Income Statement summarizes the revenues and expenses of an operation, resulting in either net income or net loss. So far, we only mentioned one revenue account and a few expenses account. Of course, take any full service hotel as an example, there are rooms revenues, food revenues, and beverage revenues; and for resort hotels, you may also have golf revenues, health club revenues, spa revenues and many others. Hotels do have many departments. Thus, a “single-step” income statement, determining net income in one step by deducting all expenses from revenues, while useful, may not be detailed enough. Therefore, there is also the “multiple-step” income statement which shows two main steps:

- Cost of goods sold is subtracted from net sales to determine gross profit, and

- Operating expenses are deducted from gross profit to determine net income

In the two examples below, all the accounts have the same values, but the ways the accounts are arranged are different in that the multiple-step income statement provides management and owners with more detailed information.

Examples: Income Statement (Single-Step)

Examples: Income Statement (Multiple-Step)

Gross Profit and Net Income

With a multiple-step income statement, the gross profit can be easily identified. You might also have heard of the term GOP in accounting. So, what is gross profit or gross operating profit (GOP)? Gross profit is simply revenues or sales minus the cost of goods sold. Therefore, if you have sales of $460,000 and cost of goods sold of $316,000, then your gross profit will be $144,000. The gross profit is an important figure because it tells you how much money is left to cover all the other costs. In the hospitality business, food/beverage and labor costs are often known as the prime costs. They can easily add up to be 60% – 70% of sales. Thus, gross profits is an important benchmark and a key performance indicator.

Examples: Gross Profit

Gross Profit = Revenues/sales MINUS Cost of Goods Sold

Net Sales $460,000

– Cost of Goods Sold 316,000

= Gross Profit $144,000

Besides expressing gross profits in a dollar amount, it can also be expressed as a percentage known as gross profit rate or gross profit margin. Using the same set of numbers, the gross profit rate or gross profit margin is calculated below.

Examples: Gross Profit Rate or Gross Profit Margin

Gross Profit Rate =Gross Profit / Net Sales

= $144,000 / $460,000

= 31.3%

From the gross profit figure, all other operating expenses are then deducted to obtain net income or net loss.

Examples: Net Income

Net Income (or net loss) = Gross Profit – all other operating expenses

= $144,000 – $114,000

= $30,000

Besides making a profit when “operating” a business, there are times that a business has “non-operating” activities which can provide revenues and income for the business and at the same time, there may also be non-operating expenses resulting from activities or facilities not controlled or managed by the operator. Some examples of non-operating income can include: cost recovery income, interest income, or other income (antenna lease income, billboard or building wall rent, retail space). And, some examples of non-operating expenses can include: rent/lease (land, building, or other property and equipment), property and other taxes (business and occupation taxes, other taxes and assessments, personal property taxes, real estate taxes), insurance (building and contents, liability, deductible), or others (cost recovery expense, gain/loss on sale of fixed assets, owner expense, unrealized foreign exchange gains or losses).

Departmental vs. Consolidated Income Statements

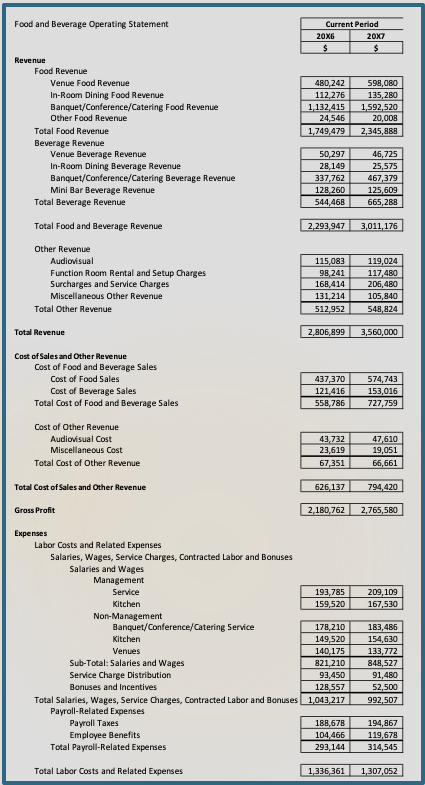

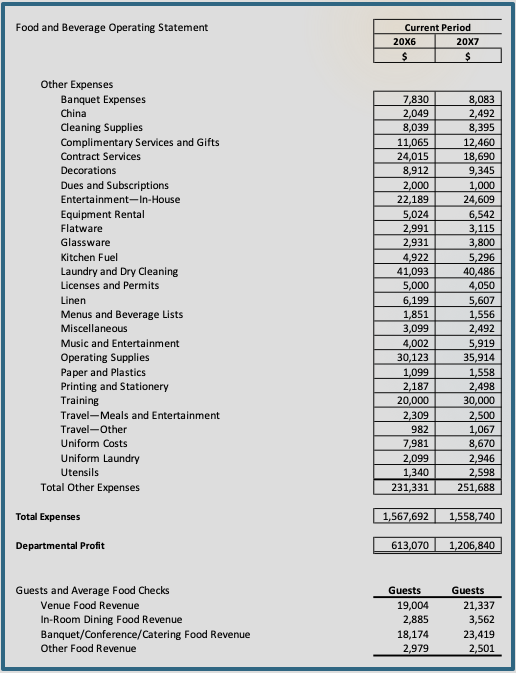

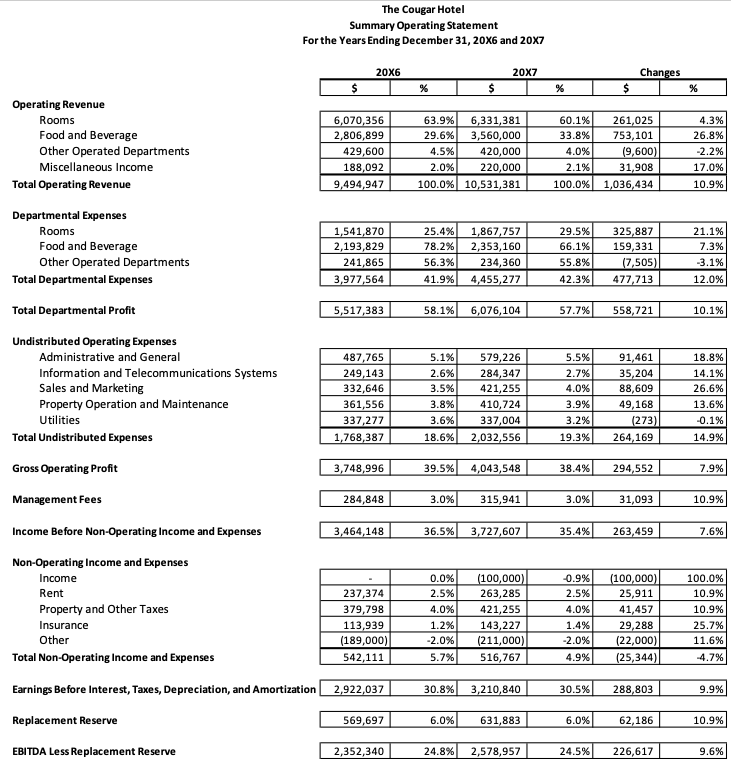

In a multi-department operation such as a hotel or a country club (and even for restaurants, they may be subdivided into dine-in, catering, and delivery), a departmental income statement allows for income to be presented for each department (rooms, food & beverage, telecommunications, parking/valet, etc.) so managers and owners can assess the efficiency and profitability of each sub-unit. When combining all departmental income statement, you will arrive at a consolidated income statement, which then allows for income to be presented for the total business. Below are examples of a departmental income statement from a food and beverage department and a consolidated income statement (also known as summary operating statement or SOS), both following the guidance of the Uniform System of Accounts for the Lodging Industry (USALI).

Examples: Food and Beverage Departmental Income Statement

Examples: Consolidated Income Statement or Summary Operating Statement of a Hotel

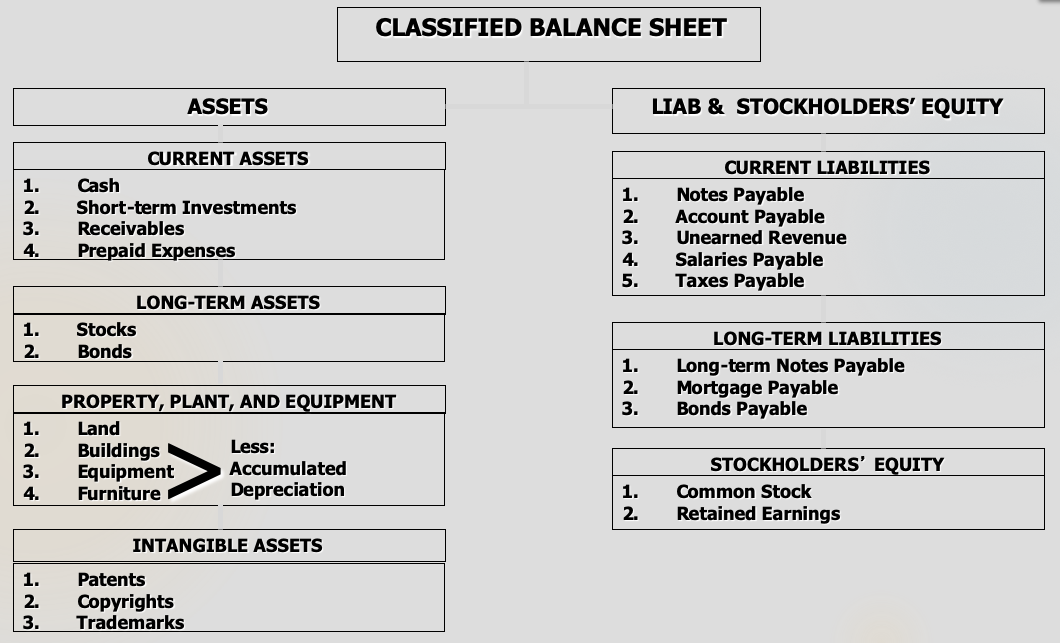

The Classified Balance Sheet

After the income statement, the statement of retained earnings should be next. However, often time, the statement of retained earnings is embedded in the stockholders’ (owners’) equity section of a balance sheet. And now that you have learned more accounts, it is also time for us to take a look at a classified balance sheet. Again, like a single- and multiple-step income statement, a classified balance sheet simply organizes the accounts more, making the balance sheet more useful to its users.

First, the assets and liabilities are further divided into current vs. non-current (or long-term) accounts. Current means the asset resources or liabilities are expected to be realized, used, or settled within one year from the balance sheet date. These accounts include accounts receivable (AR), accounts payable (AP), food inventory, tax payable, etc. Non-current means the asset resources or liabilities are NOT expected to be realized, used, or settled within one year from the balance sheet date. These can include accounts such as computer, equipment, delivery van, and mortgage loans.

Current Assets accounts includes cash and other resources that are reasonably expected to be realized in cash or sold/consumed in the business within one year of the balance sheet date. These accounts are always listed in the order of liquidity, which means how quickly they will be turned into cash. Of course, cash is cash already so cash is always the first account. Examples: Cash, short-term investments (ex: certificate of deposit), receivables (not as liquid as cash), inventories, and prepaid expenses.

Long-Term Investments can be realized in cash also. It is just that the conversion to cash is expected to take longer than one year from the balance sheet date. Such assets are typically NOT intended for use/consumption in the business’ operations. Examples: Investments in other company’s stock.

Property, Plant & Equipment are tangible resources of a relatively permanent nature that are used in the business, but NOT intended for sale. These are the assets that are subject to depreciation (land being the one exclusion). Examples: Land, buildings, machinery and equipment, delivery equipment, furniture and fixtures, and computers.

Intangible Assets are non-current resources that do not have physical substance, so you cannot actually “touch” them unlike touching a computer, a dresser, a chair, or a piece of equipment. Examples: Patents, copyrights, trademarks and trade names. These assets are also going to be amortized (depreciation of intangible assets) as they are being used up.

Current Liabilities are obligations that are reasonably expected to be paid from existing current assets or through the creation of other current liabilities. Examples: accounts payable (owe to vendors), wages/salaries payable (owe to employees) and short-term borrowings (owe to financial institutions), interest payable, and current maturities of long-term debt.

Long-Term Liabilities, on the other hand, are obligations that are NOT expected to be paid within the next year. Examples: bonds payable, mortgages payable, long-term notes payable, lease liabilities, and employee pension plan liabilities.

Owners’ Equity’s presentation depends on type of business (sole proprietorship vs. partnership vs. corporation). For corporation, OE is often divided into two accounts of Common Stock (contributions of investments to the business) and Retained Earnings (income retained for use in the business). A summary of all these classifications can be found in the key takeaway below.

Examples: A Classifies Balance Sheet

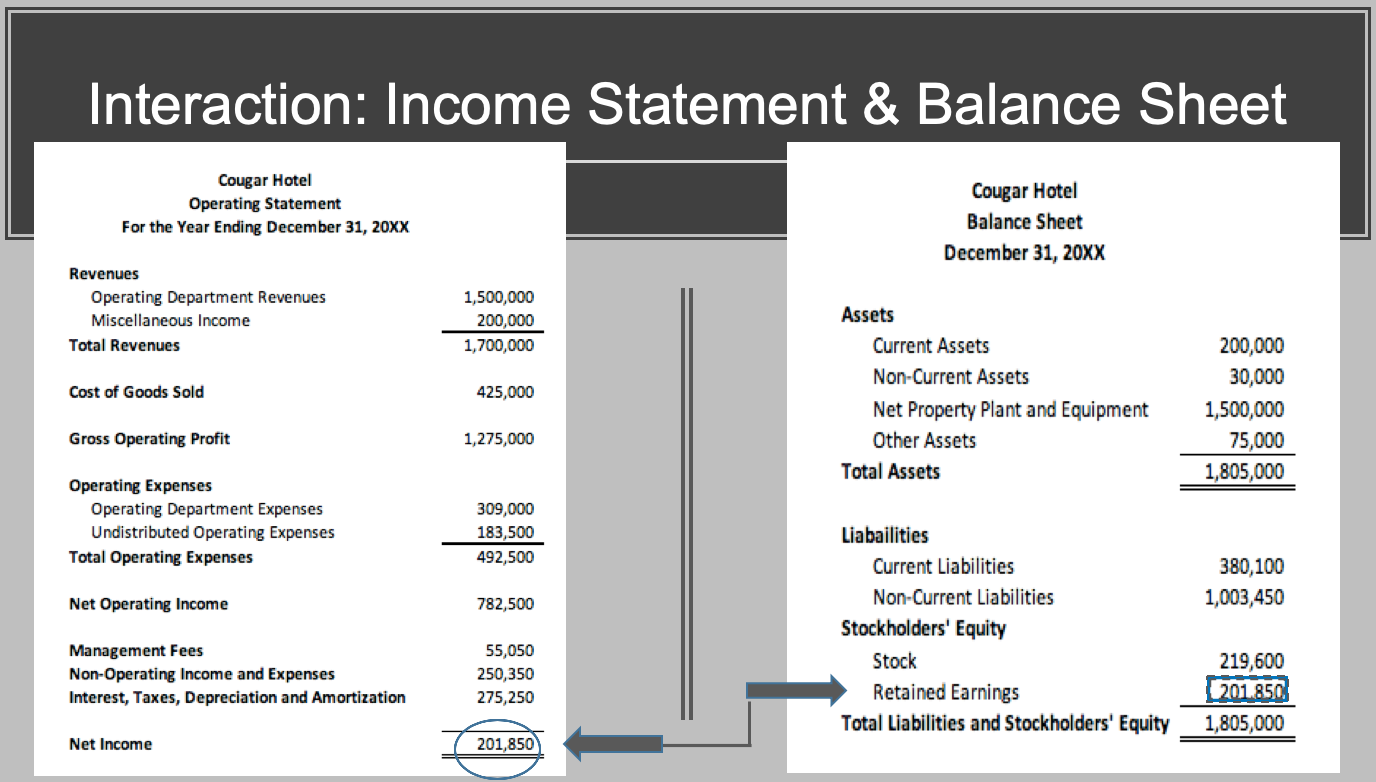

Relationship between the Income Statement and the Balance Sheet

An income statement tells the user whether a business is making a profit or a loss and a balance sheet provides the user with a list of assets, liabilities, and equity. But are these two statements related? If so, how are they related? From the closing entries in the previous module, you learned that as dollars, in terms of net income, are earned, they are closed via the income summary account to Retained Earnings. You can see this on a worksheet as well when the columns of the income statement and balance sheets are balanced out by the net income or net loss figure.

Examples: Income Statement and the Balance Sheet Together

Statement of Cash Flows (SCF)

While the income statement is useful and it tells us if a business makes money, that net income amount is not the same as cash. Since under GAAP, we are preparing accounting information using the accrual basis, there are revenues in the income statement that we might not have collected the cash yet and there are expenses included in the income statement that we might not have paid the expenses yet. But having enough cash is important in any business. Without cash, a business cannot pay their bills on time. Without cash, a business simply cannot survive. In addition, the income statement only tells us how the business “operates”. What if the business owner or the board made some good or bad investment decisions? Then, how is cash affected. And, what if the business owner or board made some good or bad financing decision (such as getting a loan with a very high interest rate)? Again, how is cash affected?

The statement of cash flows (SCF) therefore provides information about the entity’s cash receipts and cash payments during a period. These cash inflows and outflows are classified according to the activities they generate them: operating, investing and financing activities (in that order). A SCF therefore starts with the beginning cash balance of a business (the cash account value at the beginning of the accounting period from the balance sheet), adding the cash inflows and outflows from the operating, investing, and financing activities, to derive the ending cash balance shown in the balance sheet at the end of the same accounting period. In other words, the SCF explains what happened to the cash account of the business, whether the business gains cash or spends cash.

The SCF is quite useful as it assists the user in determining if the business is able to generate future cash flows, pay dividends, and meet obligations. The SCF also explains the difference between net income and net cash provided by (or used in) operating activities. And finally, it also sheds light on the cash investing and financing transactions during the period. So let’s take a look at the definitions and examples of the operating, investing, and financing activities.

Operating, Investing, and Financing Activities

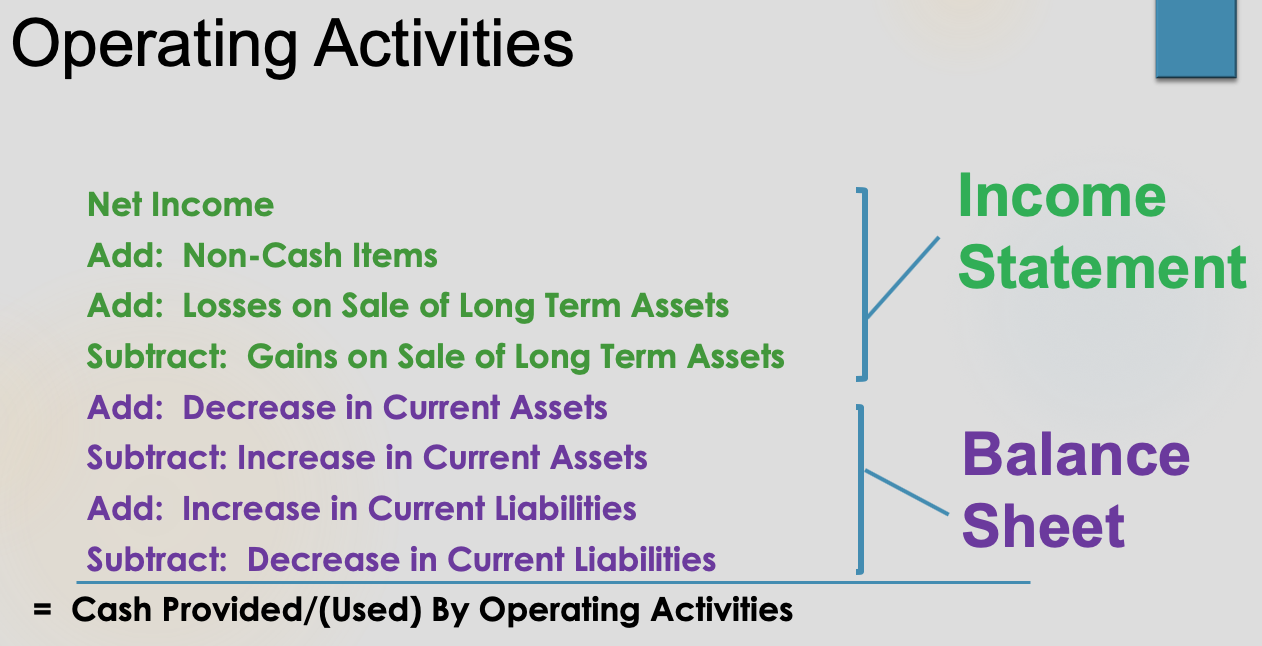

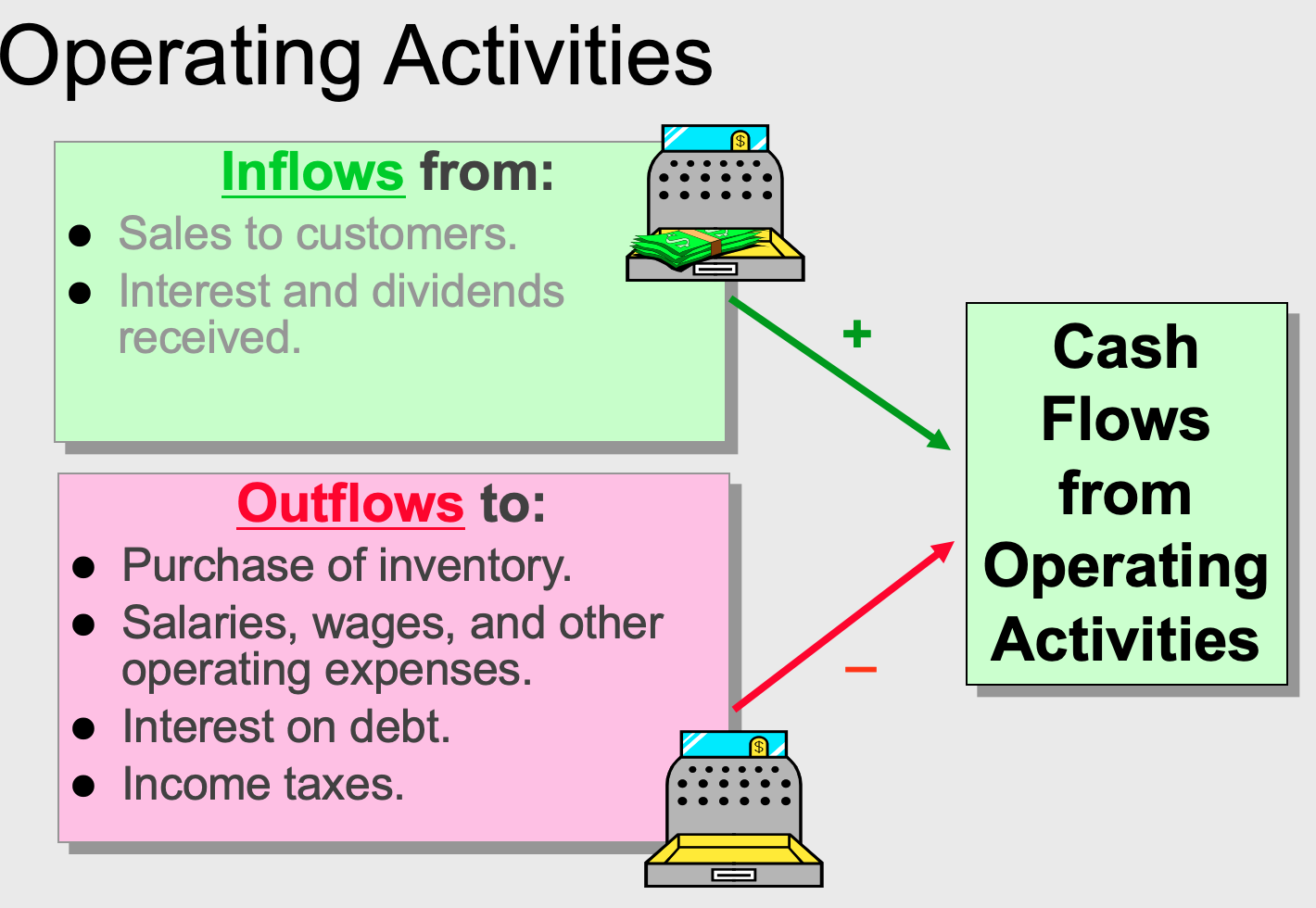

Operating activities are the cash effects of transactions that create revenues and expenses and therefore enter into the determination of net income. The word operation means operating or running the business, so revenues and expenses as summarized in net income, together with changes in current assets and current liabilities, will be included as operating activities.

Examples: Operating Activities

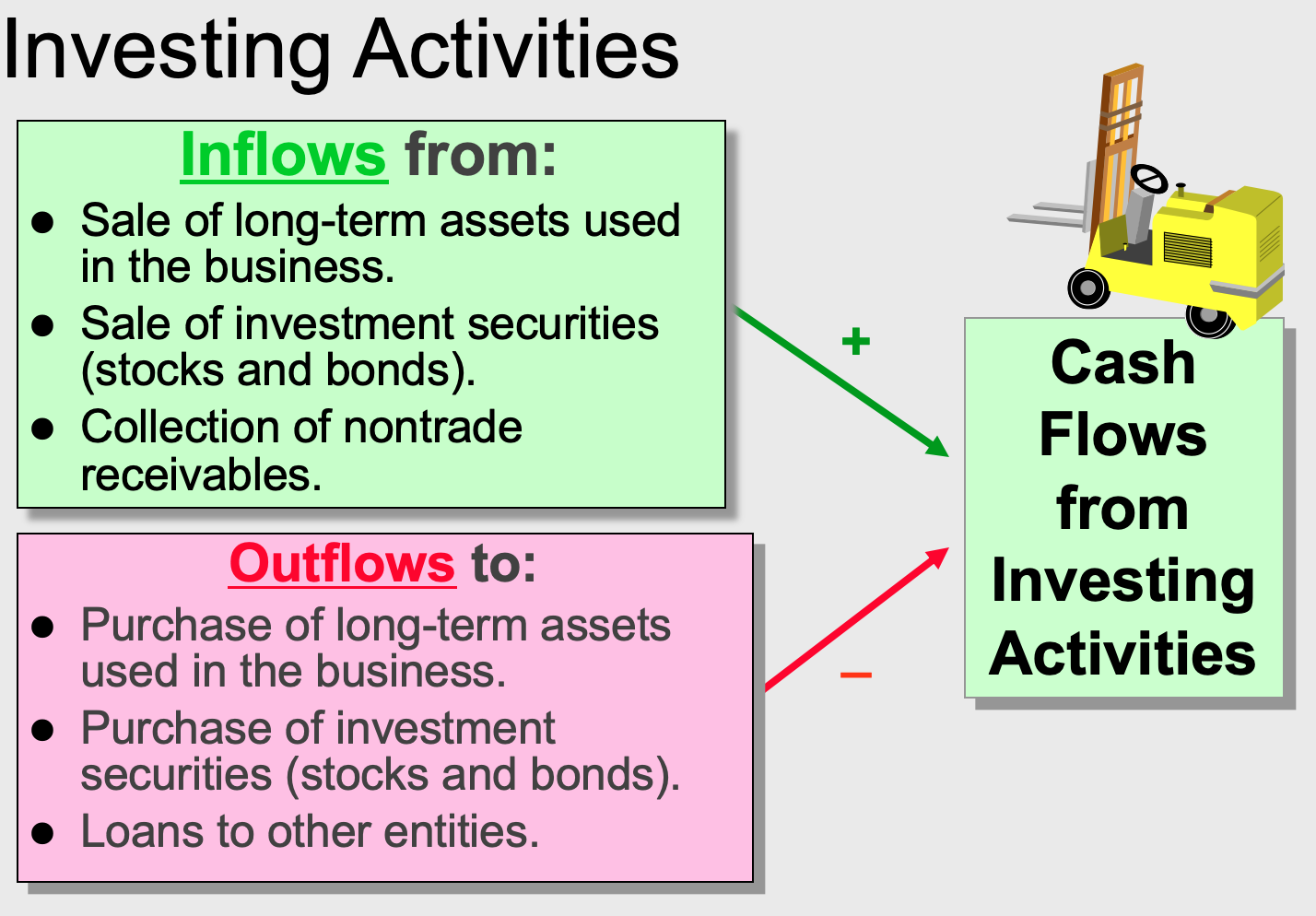

Investing activities have to do with how the business invests, which can include the acquisition and disposition (buying and selling) of investments and productive long-term assets. This category also includes lending money and collecting loans. Basically, this section shows how a business invests in its long term assets.

Examples: Investing Activities

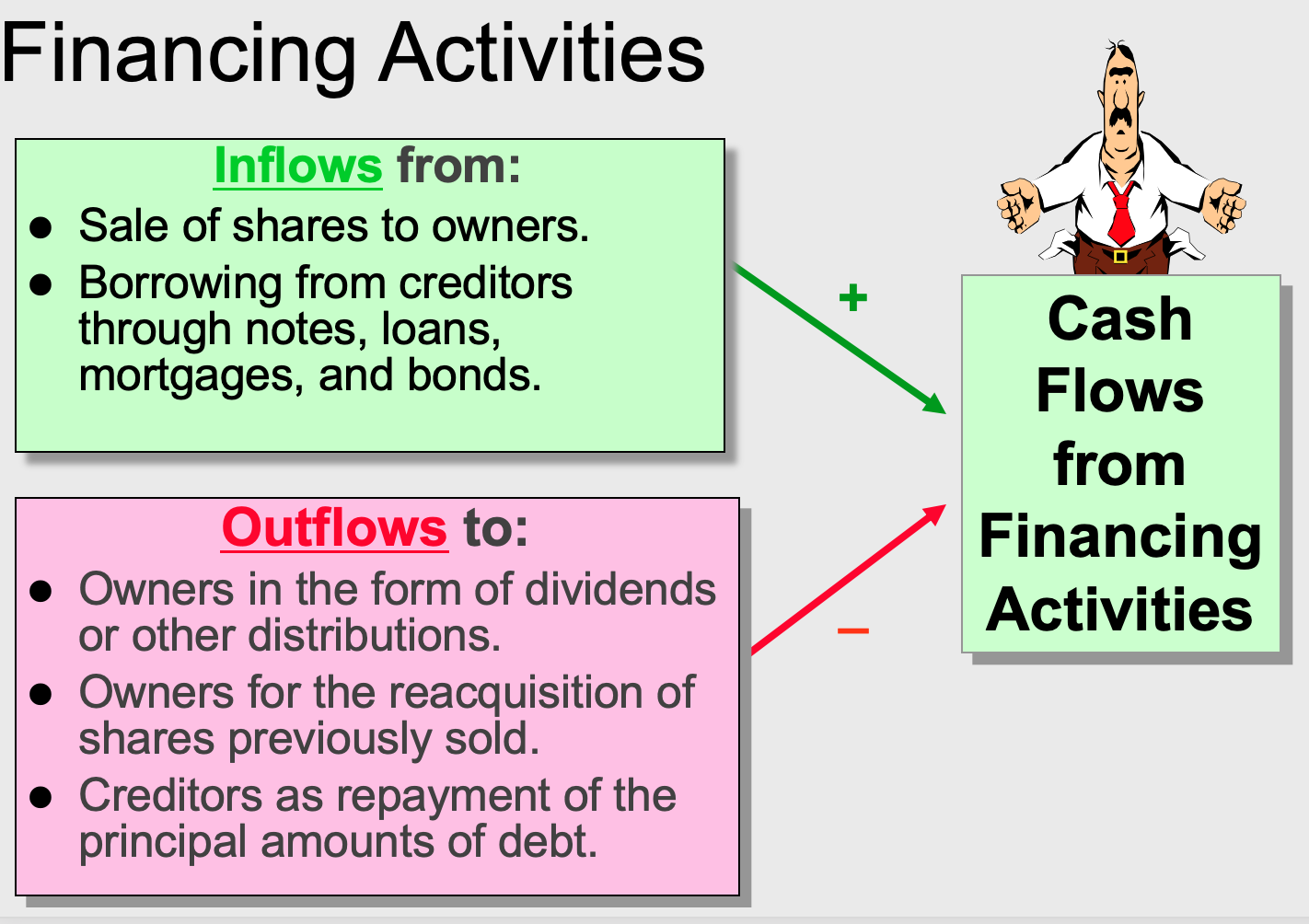

Financing Activities show how a business obtains or spends cash from “financing” sources. These activities include a business issuing debt (getting a loan), repaying the amounts borrows, obtaining cash from stockholders, and providing these stockholders a return on their investment. This category has to do with how a business raise money through its long-term liabilities and owner’s equity.

Examples: Financing Activities

Besides these three categories, there are also the significant non-cash activities. You may wonder why “non-cash” activities have to be included in a “cash” flows statement. Well, not all of these non-cash activities have to be included – only the significant ones. Because, if these non-cash activities involve cash, the entire picture of the business will be very different. Besides, following the full disclosure principle, if certain events are important to the business, they need to be disclosed. Below are some examples of significant non-cash activities:

- Issuance of stock to purchase assets

- Conversion of bonds into common stock

- Issuance of debt to purchase assets

- Exchanges of plant assets (long term assets)

These significant non-cash activities are reported separately from the main cash flow statement, normally at the very end of the statement.

Compiling a Statement of Cash Flows

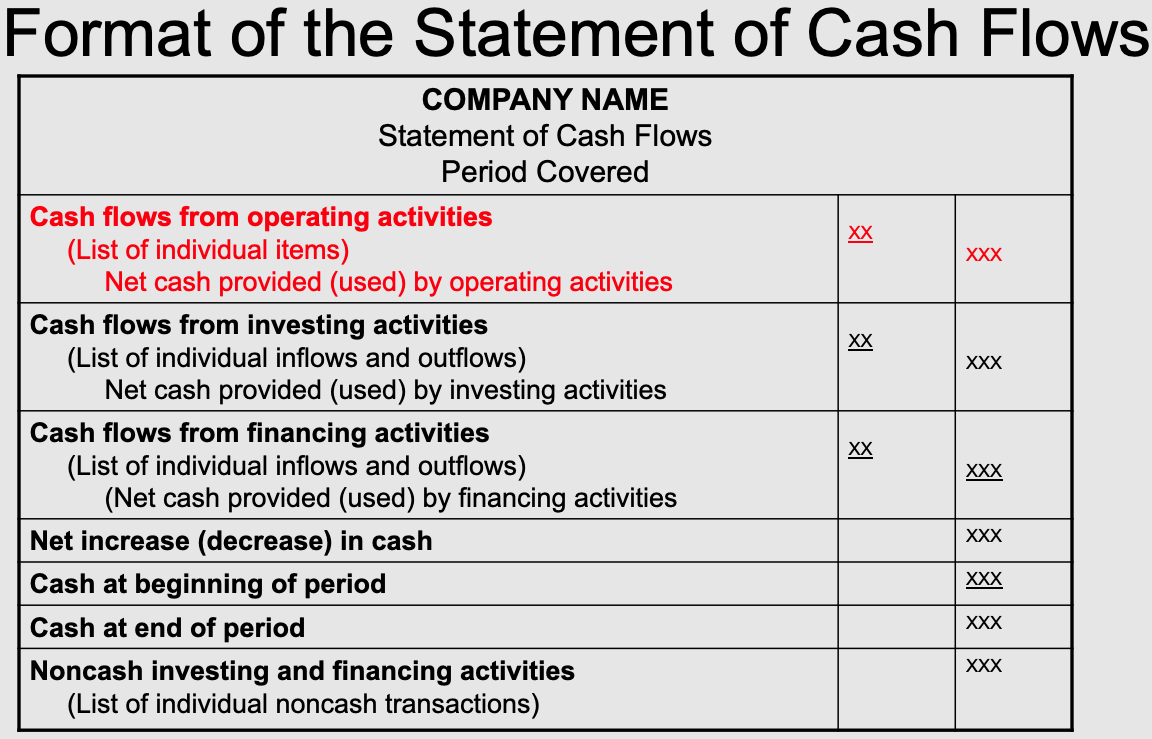

Format

First, let’s take a look at the format of a SCF. The statement the three main sections: operating activities, investing activities, and financing activities. When these three numbers are added together, you will have the change in cash for the period. Adding this change to the beginning cash balance, you will obtain the ending cash balance for the period. Then, the significant non-cash activities are listed. For this class, we will cover the operating activities section in detail. Therefore, it is highlighted in red. You will learn the other two sections in your Hospitality Managerial Accounting class.

Examples: Format of a Statement of Cash Flows

Items Needed to Compile a Statement of Cash Flows

To compile a SCF, you will need the following 4 items:

- Income Statement for the period

- Balance Sheet at the beginning of the period

- Balance Sheet at the end of the period

- Any relevant information

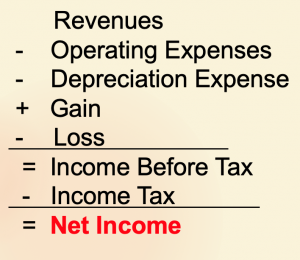

In compiling the operating activities of the SCF, there are 5 steps:

- Start with net income

- Add depreciation expense

- Add losses

- Subtract gains

- Add/subtract changes in current assets and current liabilities accounts

The information for Steps 1-4 can be found in the income statement, and the information for Step 5 can be found in the balance Sheet. Let’s see how the four item and 5 steps are put together to come up with the operating activities of the SCF.

Income Statement for the period. Recall one of the reasons why a SCF is needed is that net income from an income statement does not equal to the cash amount a business has on hand. So, you need to convert the net income figure to see how much cash is exactly provided through the operating activities of a business. In other words, how much cash is used or generated when you operate your business. Take a look at an income statement below:

So, to compile a SCF, you will:

- Start with net income. The net income figure tells us how much a business earns by being in operation (thus operating activities). As mentioned earlier, this net income figure is NOT cash, so we need to make adjustments to this number to get to “cash”.

- Add depreciation expense. A business subtracts depreciation to derive net income in an income statement. However, unlike any other operating expenses, depreciation is a “non-cash” expense as a business really has not written a check to pay the depreciation expense to anyone. Therefore, there is no cash involved and yet the amount is deducted from revenues. That cash is still in the bank account of the business! So, the first step in compiling the SCF is to start with net income and then add back depreciation expense.

- Add losses. To derive net income, a business subtracts all its losses. Yet, losses in an income statement does not mean the business operates at a loss – that is net loss (if the business does not make a net income). The losses that are subtracted in an income statement are losses when a business sells an old piece of equipment or dispose some long-term assets and is not able to recover at least their salvage values. It can also be that a business bought some stocks a while back and the value of that stock dropped. The business then made a decision to sell the stocks at a loss. These are “investing” decisions, not operating decisions. Sure, we need to account for these losses and they will be included in the “investing” activities of the SCF, but not in the section of operating activities. Therefore, when compiling the operating activities section, we need to do the opposite by adding the losses back to the net income figure.

- Subtract gains. The same logic and explanation apply to gains. Since gains are added to revenues to obtain net income, you now have to do the opposite and back them out from net income in order to get to the cash provided by operating activities. Of course, this will be included in the “investing activities” section later.

- Add/subtract changes in current assets and current liabilities accounts. As this section is on “operating activities”, assets and liabilities are needed in the operation of a business. In a restaurant, you will need to use food inventory, beverage inventory, supplies, and you may need to owe wages to employees until payday, etc. Thus, any changes in any current assets or current liabilities account WILL affect the operation or operating activities in the SCF. The Balance Sheet at the beginning of the period and the Balance Sheet at the end of the period provide you with the necessary information to complete this step and see how “cash” flows in and out. You need to look at each current assets and current liabilities account to see if there is an increase or decrease and then you will know whether you should add or subtract those numbers to adjust net income into cash. The only current asset account that you will not need to calculate a change is cash as that is the account you are trying to explain how the beginning cash balance changes to the ending cash balance.

There are four possibilities under this item:

-

- Subtract increases in current assets – food inventory is a current asset. If food inventory increases, the only legitimate reason is that you bought more inventory. And, what did you use to buy inventory with? CASH. Thus an increase in current assets is a use of cash, and therefore needs to be subtracted from net income.

- Add decreases in current asset – accounts receivable is a current asset. If accounts receivable was $500 at the beginning of the year and is only $100 at the end of the year, you have a $400 decrease. What does that mean? A/R is how much your clients owe you. If that number decreases, that mean they paid you. If they paid you, you should have more cash. Thus a decrease in current assets is a source of cash, and therefore needs to be added to net income.

- Add increases in current liabilities – notes payable is a current liability. If notes payable increases, you owe more money to your bank, and this also means the bank just loan you more money – cash, and now you have more cash. Thus an increase in current liabilities is a source of cash, and therefore needs to be added to net income.

- Subtract decreases in current liabilities – accounts payable is a current liability. If accounts payable decreases, that means you paid some of the bills you owe to your vendor so you now owe less. This also means you have less cash. Thus a decrease in current liabilities is a use of cash, and therefore needs to be subtracted from net income.

In summary, for current assets accounts, the changes have an opposite effect – that is, you subtract increases and add decreases. For current liabilities accounts, the changes have the same effect – that is, you add increases and subtract decrease.

Finally, any relevant information that may include significant non-cash activities will be included and listed at the very end of a SCF.

Key Takeaways: Compiling the Operating Activities Section of a SCF