10 Payroll

Learning Objectives

- Discuss the objectives of internal control for payroll.

- Compute and record the payroll for a pay period – deductions and the 8% tip regulation.

- Compute and record employer payroll taxes.

- Journalize payroll entries using a payroll register.

Objectives of Payroll Internal Controls

Payroll and food costs are the two prime costs of our business. The hospitality industry is a people industry. Although technology is employed extensively, the human element is always there. Thus, payroll cost is an important item of a hospitality enterprise and internal control procedures are needed. Let’s begin with some terminology regarding payroll.

There is a huge difference between salaries and wages although they are very often spoken together and some people may think that they are the same because they both are part of payroll. Salaries are compensation given to exempt employees, expressed in terms of a specified amount per month or year. An exempt employee, accordingly to the Fair Labor Standards Act (FLSA)(which you will learn in your management and human resource classes) means this employee is not subject to minimum wage rules and also does not receive over time. However, exempt employees often are offered benefits, such as paid vacation, insurance, retirement plans, etc. For example: A director of finance and accounting at a hotel earns $100,000 per year, has benefits and also receives a bonus. Wages are compensation paid to hourly employees and therefore are based on a rate per hour. Hourly employees can also earn overtime, which is generally 1.5x of their regular pay. Double-time is also applicable in certain cases though this is not regulated under the Fair Labor Standards Act. For example: A line cook earns $10 per hour.

Similar to the objectives of general internal controls, the objectives of payroll internal controls are to keep the company’s assets safe and guarding such assets against unauthorized payments of payroll. In addition, internal control procedures also help to ensure the accuracy and reliability of the accounting records pertaining to payroll.

Regarding payroll, there are four particular functions:

1. Hiring Employees – this is the responsibility of the human resources department and includes posting job openings, screening and interviewing applicants, hiring them, keeping all records of appraisals and disciplinary actions, authorizing changes in pay during the employment period, and also carrying out terminations of employment.

2. Timekeeping – this is the responsibility of the supervisor as s/he will know the schedule of when and where the employees should be working rather than someone who works in the human resources office. In keeping time, a supervisor will need to accurately track and record the hours worked by the employees. Although employees usually are required to record their time worked via a time clock, a POS, or even handwritten, a supervisor should still check these reported time against the schedule. Many time clocks now can have the schedule programmed so employees cannot sign in to work outside a limit (e.g. employee has 5 minutes to sign in before his or her schedule time but not before the 5 minute limit of his or her scheduled time) set by management. In addition, biometrics time clock using finger prints or other methods also prohibits employees signing each other in and out.

3. Preparing the Payroll – this is the responsibility of the payroll department (part of Accounting/Finance) based on the authorizations given by the human resources department. In preparing the payroll, the payroll department also approves time cards from timekeeping devices and system, maintains payroll record, prepares the payroll checks, and also prepares the payroll tax returns.

4. Paying the Payroll – this has to do with the distribution of paychecks and funding any direct deposits that are needed to be made to the employees’ account. This is the responsibility of the Finance/Accounting Department. Payment by check, and especially direct deposits to banks, minimizes the risk of loss from theft, and the endorsed check from the employees also provides proof of payment. When issuing paychecks, all checks must be signed by the treasurer and their distribution should be controlled by the Finance/Accounting Department. Some businesses may take it a step further to require the signatures of the treasurer and an additional officer, again to deter fraud.

Compute and Record the Payroll for a Pay Period

Determining the Payroll

In any payroll, there are three major part: gross earnings, payroll deductions, and net earnings. The formula therefore is:

Net Pay = Gross Earnings – Payroll Deductions

Gross earnings is the total compensation earned by an employee. It can be a salary or it can be the hourly wage rate multiply by the hours worked, including any overtime or double time. Payroll deductions can be voluntary & mandatory. Think about your first paycheck. When you employer offered you $10 an hour and you worked 10 hours, why was it that the paycheck you took to the bank to deposit was less than $100? Well, because we all have to pay payroll deductions.

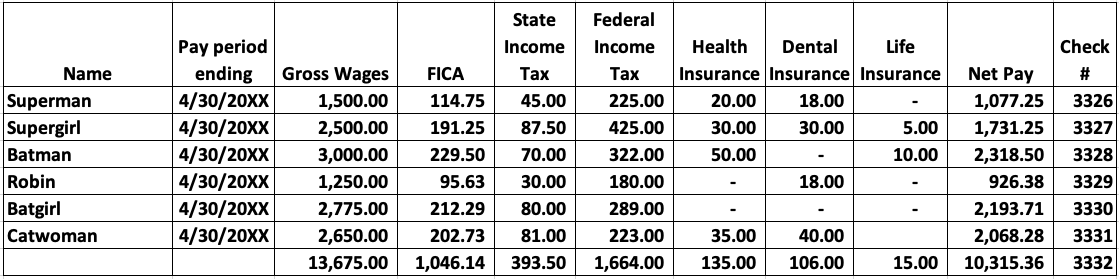

Some common deductions are your federal income tax, state income tax, and FICA taxes. Before your first day of work, you had to fill out a number of employment forms. One of them is the W4, which states the amount of withholding you wish to have from your payroll check. The amount being withheld depends on your gross earnings, the number of allowances you claim, and the length of the pay periods (weekly, monthly, etc,). All individuals have to pay federal income tax. There are some states in the US that do not have a state income tax (Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming). And all have to pay FICA taxes. FICA taxes are designed to provide workers with supplemental retirement, employment disability and medical benefits and you may know it as social security tax. Besides these mandatory deductions, individuals may opt to have additional deductions made to their paychecks for retirement, insurance, union dues, charity, or others. In the sample payroll register below, Superman has wages of $1,500 but after all deductions, his net pay on his paycheck is $1,077.25.

Examples: Payroll Register

Recording the Payroll

Employers must keep detailed, cumulative records, known as a “payroll register” to recognize all payroll expenses & liabilities with the correct and appropriate amounts debited to the expenses and credited to the liabilities accounts. When you did your transactions in Module 3 and Adjustments in Module 4, payroll was simple. You were told that you paid $300 in wages and you would debit $300 in wages expenses. If you paid cash, you would credit cash, and if it was an accrual, you would credit wages payable. At that time, we have not talked about all these deductions, taxes, and everything else. Now we know there is more than one account of wages expense, and that the employer is withholding all these amounts so as to help the employees to remit these amounts to the government and various agencies, the payroll entry is not just one debit and one credit anymore.

Besides deductions, there is one more item that is peculiar to the hospitality industry – TIPS. Now, the FLSA does establishes guidelines on minimum wage, overtime pay, record keeping, and even youth employment standards for employees in the private sector and in federal, state, and local governments. The FLSA also provide guidance for special hourly rates for tipped employees (tip credit). In other words, since tipped employees will receive tips, employers do not need to pay them the required minimum wage. In addition, under the Tax Equity and Fiscal Responsibility Act of 1982 (TEFRA), there are regulations guiding food and beverage operations to ensure tipped employees to report at least 8% of their sales as tips. If employees report less than 8% of their sales, employers will need to allocate a tip amount to the employee’s paycheck.

8% Tip Regulation

To begin, this 8% tip reporting does not mean that if you are receiving tips, you only need to report 8% of your tips. NO! You are supposed to report ALL tips received. The 8% has to do with tip allocation. Please note that the title is linked to the IRS site so you can read more in detailed.

As an employer, you are supposed to file IRS Form 8027 at the end of each year which summarizes the restaurants total sales, charged sales, charged tips and total reported tips. As long as tipping is customary, a restaurant where food and beverages are served, and more than ten employees are normally employed must submit the form. The employer is to highlight any shortfall of reported tips below 8% of gross receipts from F&B sales. If total reported tips are less than 8% of total receipts, additional tips will be allocated to the W2 of every tipped employee that reported less than 8% of their gross receipts.

If a restaurant, hotel, or other establishment levy a service charge on the customers (such as any table of 8 will have an automatic 20% service charge), these amounts are not tipped wages but rather regular wages, to be included in the regular rate of pay for overtime and minimum wage calculations. Again, the IRS regards amounts voluntarily paid by customers to tipped employees as tips, and tips are not included in the calculation of the rate of pay applied to overtime hours. For example, a restaurant imposes a mandatory 18% for parties of six or more. In this instance, the customer is not free to pay more or less than the mandatory amount. The ruling concludes the amount is a “service charge” and thus a “wage” for federal tax withholding and reporting purposes. This term of service charges is not specific to F&B, but includes any service charges which are automatically added, i.e. Spa, Room Service, etc.

Compute and Record Employer Payroll Taxes

Employers’ Tax Responsibility

You have looked at all the items that an employee needs to pay whereby the amounts are deducted from their paycheck to derive net pay. What about the employer? Besides paying the wage rate and salary amount, do they need to pay any taxes too? Yes, employers also have to pay employer payroll taxes and there are three of them:

- FICA Taxes – While employees have to pay FICA taxes, employer also have to match the employees’ contribution and pay the same amount toward supplementing the employees’ retirement, and medical and disability expenses when employees reach retirement age.

- FUTA – The Federal Unemployment Tax provides federal benefits for a limited period of time to employees that lose their jobs due to no fault of their own. You may have heard of people collecting unemployment benefits. If a person is dismissed because he or she did something wrong, he or she cannot collect unemployment.

- SUTA – The State Unemployment Tax works the same as FUTA, but is levied by the state.

Besides these three mandatory taxes, state worker’s compensation insurance, though is available in all states, are not required by all states. However, as in any insurance, it really benefits both the employers and employees in that the majority of businesses do carry state worker’s compensation insurance. As for state disability insurance, only five states California, Hawaii, New Jersey, New York and Rhode Island, have mandatory state disability insurance.

Filing & Remitting Payroll Taxes

With all these taxes being withheld from employees and mandatory taxes employers are supposed to file, there is a set time for businesses to pay all the taxes:

- FIT and FICA can be combined and reported to the IRS on a quarterly basis, no later than one month following the close of each quarter

- FUTA must be filed and remitted annually

- SUTA must be filed and paid quarterly by the end of the month following each quarter

Therefore, at the appropriate time, a business will remit the taxes collected (deducted from employees’ gross pay) from employees and its own tax obligations to the government.

Payroll Entries

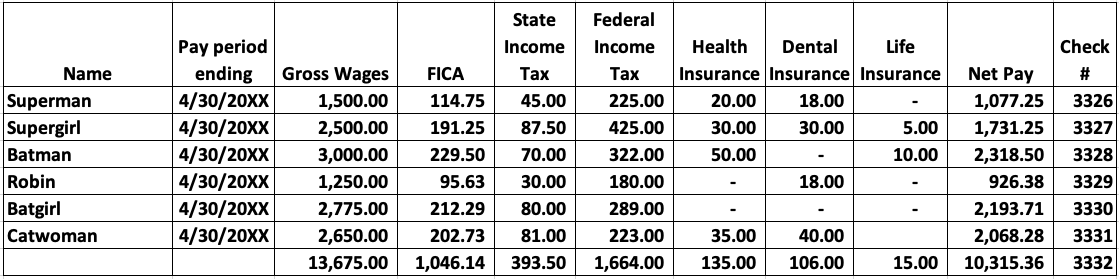

The simple entry of debiting wages expense and crediting cash or wages payable will now need to be modified and expanded to include all the payroll deductions from the gross pay of the employees and also the employer’s payroll tax obligations. Let’s continue with the payroll register you saw earlier in this module:

Examples: Payroll Register

In this particular example, we need to record all the necessary transactions for 4/30, 5/5 and 5/15. The end of the pay period is 4/20. The payroll will be paid to the employees on 5/5 and all taxes and other obligations need to be paid to the government and other agencies on 5/15. The federal unemployment tax is at 0.6% and state unemployment tax is at 5.4%.

There are essentially 4 steps for journalizing any payroll entries:

- record wages expense on the day it occurred, observing accrual basis of accounting and the matching principle to match payroll expense with revenues earned in the same period – in this case 4/30.

- record employer’s payroll taxes, again observing accrual basis of accounting and the matching principle – in this case 4/30.

- record payment of wages on pay day – in this case 5/5.

- record payment of all taxes and related expenses – in this case 5/15.

And, the analysis of each step is listed below.

Examples: Step 1. Record Wages Expense

Step 1 : Record Wages Expense:

Analysis:

Six employees worked for this business with a payroll ending date of 4/20. Gross wages were $13,675. Six deductions were listed, netting total net pay at $10,315.36. Wages are not to be paid later so while there is a wages expense, there will be a wages payable until 5/3 when the paychecks will be cut. All the taxes and insurance withheld from the employees on 4/30 are to be recognized as liabilities of the business to then be paid on 5/15. Thus there will be six liabilities (six payables) on 4/30. Therefore, in Step 1, you should debit wages expenses as that is what the business used for payroll during this pay period. And, this amount is divided into seven parts (seven different liability accounts), where the business has seven liabilities that it needs to pay on 5/3 and 5/15 (wages on 5/3 and all the deductions on 5/15).

Conclusion:

Debit wages expense and credit all seven liabilities using the column totals of the seven respective accounts.

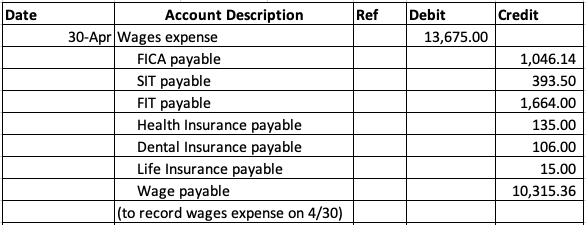

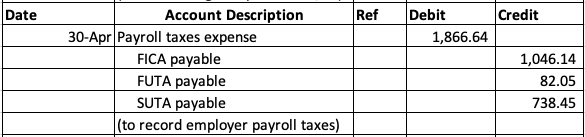

Examples: Step 2. Record Employer’s Payroll Taxes

Step 2. Record Employer’s Payroll Taxes

Analysis:

The employer has three mandatory obligations, FICA, FUTA, and SUTA. The percentage rate for FICA is not given but there are two ways to find out. First, since the employer has to match the employees’ contribution of FICA, whatever the employees pay, the employers will have to match. Thus, FICA payable is $1,046.14. Second, like any payroll related tax, FICA is levied on gross pay. So, you can divide $1,046.14 (the amount the employee paid) over the gross pay of $13,675 and obtain 7.65%. Then multiplying 7.65% again to $13,675, you will still obtain $1,046.14 as your FICA for the employer. Thus the first method is most direct.

To obtain the amount of tax owed on FUTA, multiply the tax rate of 0.6% to $13,675 = $82.05.

Similarly, for SUTA, multiply the SUTA rate of 5.4% to $13,575, you will obtain $738.45.

Now, you have three credits; add all the credits together (since debit has to equal to credit) and your total payroll taxes expense will have a debit of $1,866.64.

Conclusion:

Debit payroll taxes expense of $1,866.64, and credit each tax liability and their respective amounts.

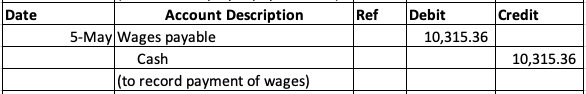

Examples: Step 3. Record Payment of Wages on Payday

Step 3. Record Payment of Wages on Payday

Analysis:

On May 5, when the business pays the employees, they liability of wages payable will be cancelled out and cash is used to pay the employee of the net pay amount owe to them.

Conclusion:

Debit wages payable, a liability, to decrease a liability; credit cash to decease cash.

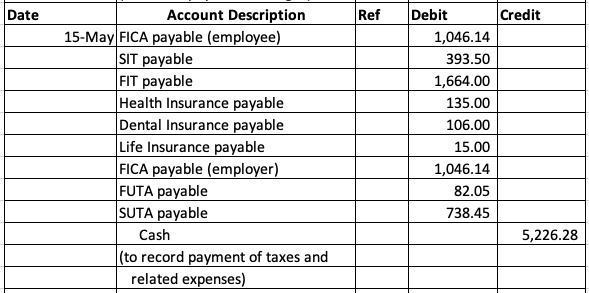

Examples: Step 4. Record Payment of All Taxes and Related Expenses

Step 4. Record Payment of All Taxes and Related Expenses

Analysis:

On 5/15, all liabilities have to be paid so all liabilities have to be debited. Note there are two FICAs, one from the employees, one from the employer, and they should be of equal amounts. All these debits will be added together to come up with the cash needed to pay off all these debts. Thus, the six liabilities from employees withholding and the three employer payroll tax liabilities will be decreased. Liabilities have normal credit balances. To decrease them, they all need to be debited.

Conclusion:

Debit all liabilities (payables), credit cash to decrease cash.