9 Internal Controls and Cash

Learning Objectives

- Define internal control.

- Identify the principles of internal control.

- Explain the applications of internal control principles to cash receipts.

- Explain the applications of internal control principles to cash disbursements.

- Indicate the control features of a bank account.

- Prepare a bank reconciliation.

Internal Control and its Principles

What is Internal Control?

Internal control is the safeguarding of assets from any unauthorized use including employee theft and robbery. Control procedures enhance the accuracy and reliability of accounting records. With rules and procedures to follow, the risk of errors and irregularities in the accounting process can also be reduced.

Principles of Internal Control

There are five main principles of internal control:

1. Set responsibilities – control is most effective when only one person is responsible for any given task. By setting duties, you are also holding employees responsible for the output of their work.

2. Separate and segregate duties – this is when the work of one person is set so that it is either independent of, or serves to check on, the work of another. Having two people to take inventory while one counts and calls out the amount and another inputs the amount and do the extensions not only serves as checks and balances for the accuracy of work but also can lessen the temptation of collusion.

3. Document – having documentation will leave a “paper trail” or evidence. In today’s cyber world, the paper trail can actually be a paperless trail where approvals are given online, where invoices, purchase requests, and/or purchase orders are automatically numbered, where accounts can be set with specific and/limited access.

4. Physical, mechanical and electronic controls – this has to do with safes, lockboxes, biometrics time clock, etc. All these devices and systems can deter theft, which is one of the aims of internal controls.

5. Independent internal verification – if you work in a hotel or a large restaurant chain, you might have seen an internal auditor visiting from the regional or corporate office. These individuals will come to your operation and perform a review, compare documents, and reconcile a sample of data prepared by other employees so as to make sure all procedures are properly followed, data are correct, and no theft or bad dealings exist in the operation. These audits can be done periodically but best be on a surprise basis. They also can be performed by a third party not directly associated with the company, and thus providing an independent perspective. At the end of the visit, any discrepancies found will be included in a report to management.

Again, in today’s tech world, many control procedures are done via technology such as verification emails, electronic approvals, or notifications of activity/changes requiring approval. In addition, with the ease of accessibility via the cloud option, there is no reason why technology should not be employed. Of course, there are limitations to internal controls as they generally only provide reasonable assurance and not 100% fraud or theft free. And, there is always the cost vs. benefit angle. For example, a mom-and-pop establishment can hardly afford a biometrics time clock if they only have 3 employees, nor is there a need. Yet, humans are imperfect and temptations are always out there. Thus, depending on the size of the business, owners need to adopt proper internal control procedures for their own operation.

When it comes to fraud, do know the “Fraud Triangle”. There are three components to the fraud triangle – pressure, opportunity, and rationalization. Pressure is when an individual has a financial need that s/he believes that such need cannot be solved through legitimate and ethical means. At the same time, an opportunity exists thereby this individual sees a way, has a chance, and has the ability to misappropriate assets by overriding existing controls or because there are lack of controls in place. Finally, the individual rationalizes and justifies his or her own wrong behavior and commits the fraud. For instance, the person may feel that the company has not given him or her a raise for a while and s/he deserves the raise and should have received one a long time ago, thus making this “theft” justified. It could also be the individual thinks s/he will just “borrow” the money from the safe and will “return” it to the business in the future – so this person justifies the theft a loan.

Applications of Internal Control Principles to Cash Receipts

How can a business make sure that the cash they take in are correct and at the same time it is deterring illegal activities such as robbery and theft? To start with, in smaller establishments or in most quick service restaurants, when a cash register is used, make sure the cash register is visible to the customers so that the total dollar amount charged is always visible to customers when they pay. Also, always provide receipts to customers – that is the documentation principle. And at the end of the shift, run the register report so that the sales detail can be provided to management for verification. If credit cards are accepted, the same principle applies.

If your business receives checks or money orders from customers by mail, make sure all checks and money orders are logged. If your bank is collecting cash for your business, then keep track of all remittance notices and balance everything out at least once every month. When a check is received, also stamp “For Deposit Only” on the back of the check as a restrictive endorsement so the check cannot be cashed.

With new technology such as check deposit machines, or automated clearing house (ACH), credit cards, e-pay options, wire transfers, or even good old-fashioned lockbox services provided by banks, make sure there is a record of the cash that your business received and reconcile the records with the actual cash recorded.

Applications of Internal Control Principles to Cash Disbursements

On the cash disbursements side, the most important procedure is to use a voucher system for any purchases. A voucher system begins with an authorization to incur an expense or cost and ends with the issuance of a check. This can be done by paper or via technology. A voucher system provides the paper trail needed and also conforms to the principle of segregation of duties so no one person can just take money from the business to purchase anything without proper authorization.

Electronic funds transfers (EFT) is also a good way for disbursing cash as there will also be an electronic paper trail provided. Of course, the individuals who have access to the ETF accounts are also pre-approved to conduct transactions.

Again, new technology is also enabling purchase cards and paperless accounts payable systems. If an employee has a purchase card, s/he can use that particular card, again, for pre-approved purchases and also even pre-approved amounts, thus restricting the number of people who can have access to the company’s fund and eliminating paper work on reimbursements.

Finally, electronic A/P systems allows the direct deposit of payments without the actual writing and mailing of checks, thus eliminating mail fraud, or checks being stolen. Once again, all these procedures cannot eliminate all theft, fraud, or robbery. However, the absence of internal controls will surely invite troubles.

A Bank Account

Why should a business use a bank account? Well, as individuals, we all have bank accounts. And as a business, banks provide you with many services that can assist you in managing your cash and also in your internal control procedures. Having a business bank account can:

1. Minimizes the amount of cash on hand – although credit cards and now e-pay are used quite extensively, there is always a cash component. And, even when you receive a check from a client, that is still cash. A bank account allows you to deposit all such funds and secure the cash for your business. You do not need to hide the cash in your place of business or at your home. You should not do that to begin with.

2. Creates a double record of cash events – having a bank account is like having an extra accountant. Your bank statement will show all your cash inflows (deposits you make) and outflows (bills you pay) and the proper balance. This can all help you manage your monetary resources. In future accounting/finance classes, you will learn about budgeting and especially a cash budget. Your bank records will be a great help in compiling a cash budget because it will show a pattern of your cash inflows and outflows.

To observe the economic entity principle, it is also proper for you to separate your personal bank account with your business bank account.

The Bank Reconciliation

When you receive a bank statement at the end of the month and you compare what the statement said you have in the bank and you look at the balance of your cash account, those two numbers seldom equal. Did you make a mistake? Did the bank make a mistake? While there certainly is a possibility that either party or both could have made a mistake, chances are these two numbers are not equal because of time lags.

Time lags prevent one of the parties from recording the transaction in the same period. Think about when you made a deposit – even if you are taking a photo of a check, front and back, and use the app on your phone to deposit a check – does it mean as soon as you hit the submit button, the funds will magically appear on your account? No, because your bank has to then take the check you deposited and work with the bank of the issuer of the check and collect the funds for you before the funds will appear in your bank account so that you can access the funds.

On the other hand, even if you pay a bill online, say to pay for your utilities, it also does not mean that as soon as you hit the submit button, the electricity company will receive your money at that instance. That is the time lag. And therefore rarely will those numbers be the same, and thus a bank reconciliation is imperative. This especially true for a business that has many transactions and cash, bills, checks, all flowing back and forth between clients, banks and financial institutions. Remember, it is your business, it is your money, it is your cash. You want to make sure that your cash balance is correct and secured.

Four Steps of a Bank Reconciliation

To prepare a bank reconciliation, just follow 4 steps:

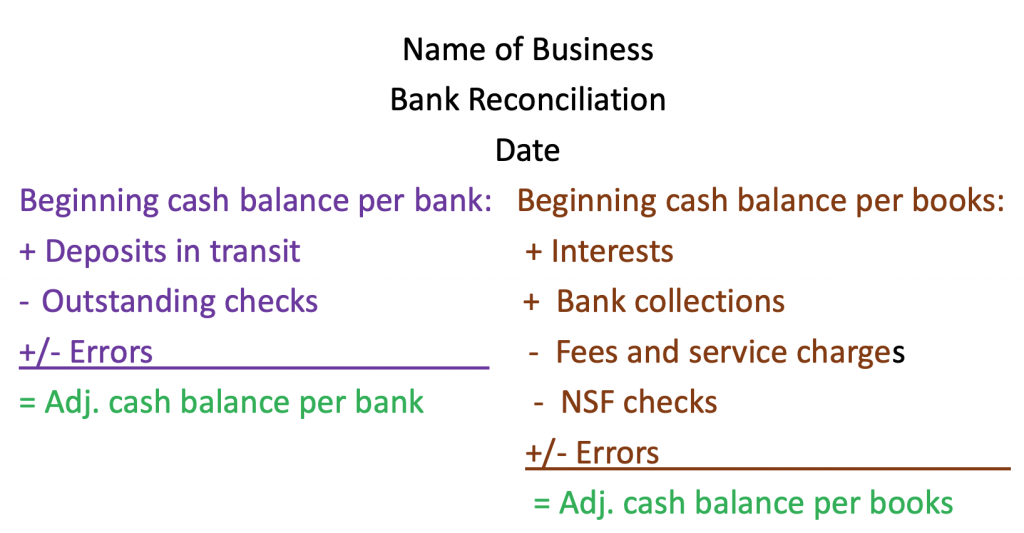

- Start with the balances you see on the bank statement and that of your books – these are your beginning balances, and they are not the same (hence the need of a reconciliation). Now, include in both sides items that each side is NOT aware of. The goal is transparency on both sides. At the end of the reconciliation, the ending balances should be equal.

2. On the bank’s side:

-

- ADD: Deposits in Transit – deposits we have made on our books, but the bank did not know about and therefore such deposits are not on the bank statement

- SUBTRACT: Outstanding Checks – disbursements we have made on our books, but due to time lag, they have not appeared on the bank statement as yet

- ADD OR SUBTRACT Errors – do what is needed to correct the error. E.g., if the bank made an error and added $10 more dollars to your account, then they will need to SUBTRACT $10.

3. On the book’ side:

-

- ADD: Interest – banks will give accounts interest at the end of the month. Most business accounts will have some level of interest. You as a business will not know the exact dollar amount until you see the statement.

- ADD: Bank Collections – any funds that the bank collects on your behalf that you are not aware of will now show up on the bank statement. Go through the bank statement and add those collections to your beginning book balance. You will not know beforehand what all these collection would be or who had paid you. But now that you have received the bank statement, you have the documentation to make these changes.

- SUBTRACT: Fees and Service Charges – banks do not work for free. If we do not keep a minimum balance, we may incur a charge. If we deposited a check from a client that is a bad check (NSF – non-sufficient funds check), there will be a service charge. Go through the bank statement and subtract all fees and charges from your beginning book balance. Again, for charges like these, you will not know beforehand what all these charges might be. But now that you have received the bank statement, you have the documentation to make these changes.

- SUBTRACT: NSF checks – As mentioned earlier, if you made a deposit and added that amount to your books, trusting that the check was good, and then it came back from your bank noting that that such check was an NSF check, you will now need to deduct that amount from your books.

- ADD OR SUBTRACT Errors – do what is needed to correct the error. If you find an error that you have made, you will need to either add or subtract that amount. For example, you deposit a check for $550 when it should only be $500. When you see the bank statement, and it only shows $500, you go back to your record and see that you made an error. So, now, you will have to subtract $50 from your books so it will be the correct amount as shown in your bank statement.

- Bank Memoranda – Besides the bank statement, banks will sometimes send a memorandum or a letter to you to notify you of any changes to your account. Do trace and record any information from such bank memoranda.

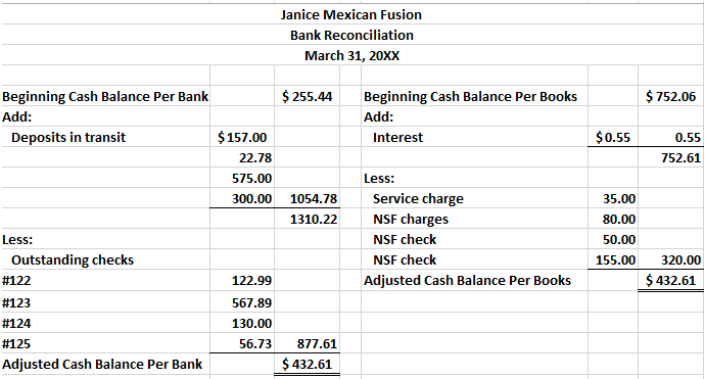

The format for a bank reconciliation, therefore, is as follow:

Examples: Bank Reconciliation

Your friend Janice, just started her business Janice Mexican Fusion, a catering/delivery business last month, and she has a bank account for her business. She just received her very first bank statement and the balance of $255.44 is way short of what she shows on her books of $752.06, and so she is asking for your help. She tells you that she has written a few checks and made a few deposits the last two days but they are not on the statement.

The following checks are those she wrote:

#122 in the amount of $122.99 to the City of Houston for the electricity bill

#123 in the amount of $567.89 to Fresh Produce for food purchased

#124 in the amount of $130.00 to a printer place for advertising, and

#125 in the amount of $56.73 to Office Depot for office supplies

The checks she deposited but are not shown on the statement she just received are:

- A check of $157.00 from Mr. Jones

- A check of $22.78 from Quality for purchases returned

- A check of $575.00 from Denver Consulting for their grand opening party

- A check of $300.00 from Ms. Apple for a baby shower for her daughter

During this month, the bank charged Janice a fee of $35. And, since this is her first business, she is not too strict in her check verification and therefore had two NSF checks of $50 and $155. For each NSF check, the bank charged her $40 of NSF charges totaling $80. Since Janice only has a small balance in the account, the bank only paid her $0.55 this month as interest. Please prepare a bank reconciliation to show Janice the correct amount of cash that she has in her business. Use March 31, 20XX as your date.