4 Adjusting the Accounts

Learning Objectives

- Explain the time period assumption.

- Explain the accrual basis of accounting.

- Explain why adjusting entries are needed.

- Identify the major types of adjusting entries.

- Prepare adjusting entries for prepayments.

- Prepare adjusting entries for accruals.

- Describe the nature and the purpose of the adjusted trial balance

Time Period Assumption, Accrual Basis of Accounting, and Adjustments

In Module 2, we learned one of the guidelines in GAAP is the time period assumption where accountants divide the economic life of a business into artificial time periods such as months, quarters, etc. In real life, however, not everything is neatly packaged by the same time period we used for accounting. One good example is that when you work as a part-time hospitality associate, you are paid normally every two weeks on a certain day. And, most of the time, it is every other Friday. Yet, the Fridays are not normally the end of the month such as March 31 or June 30. So, how would the business you work for account for their payroll cost, how much do they owe you, and how much should they pay you?

At the same time, what we study here, and also according to GAAP, is the accrual basis of accounting. Accrual basis goes hand in hand with the revenue recognition and also the matching principle in that revenue is recorded when it is earned (not when the business receives the cash) and expense is recorded when occurred (not when the business pays). On the other hand, there is cash basis of accounting where accounting work is only done or recorded when cash changes hand. This of course violates GAAP! Yet, for very small businesses, they may operate on a cash basis of accounting and then give all the details to a certified public accountant to help them “sort things out”. In all the major restaurants, clubs, hotels, and other hospitality operations that you work with, unless they are very small businesses, they all abide by the accrual basis of accounting.

Therefore, adjusting entries make it possible to report the appropriate assets, liabilities, owners’ equity, revenue & expenses in the proper accounting period. Again, adjustments or adjusting entries are needed because:

- Some events are journalized because it is inexpedient to do so like the consumption of food inventory. You wouldn’t want to adjust the amount of inventory you have on hand after every single time a hamburger is served at your restaurant. Think about this – if you do, how much would you adjust? One bun, 8 oz of beef, 1 slice of cheese, 1 slice of 4X5 tomato, 1 piece of green leaf lettuce, and 1/2 ounce of mayonnaise? The list can go on and on and this is simply not practical.

- Some costs expire with the passage of time rather than a distinct event, like insurance or rent. On a personal basis, your car insurance is normally renewed every 6 months and you prepaid that insurance before the insurance takes into effect. And, every month as time passes, the worth of your 6-month insurance will decrease. Again, you do not adjust for your own car insurance every mile your drive your car. So, it will be impractical for a hotel, restaurant, or other hospitality businesses to recognize the insurance they spend on their delivery van, etc. as soon as they take a certain drive. Thus, adjustment is needed.

- Some items may be unrecorded such as a utility service bill. Expenses such as utilities, you used up the resources first and then the water, gas, or electricity providers will look at your usage and then bill you. So, these are items that you have used but you have not paid for as yet.

If adjustments are needed, when do we do them? You are to perform adjustments every time financial statements are prepared! If not, the numbers you use to prepare the financial statements will not be correct!

Key Takeaways: When to Perform Adjustments

You are to perform adjustments every time financial statements are prepared!

The Four Things We Adjust

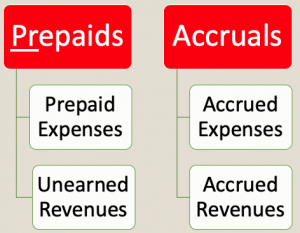

There are 4 categories of adjustments what you will need to know to perform right before you prepare your financial statements so that the figures you use will be correct. These 4 categories are divided into 2 main parts: prepaids and accruals.

Prepaids

Prepaids are money that either you have paid your vendors or that your clients have paid you “before” any service is performed or products are sold.

- Prepaid expenses – these are expenses that you paid to your vendors in cash and are recorded as assets before they are used/consumed (e.g. prepaid insurance, food/beverage inventory, rent, delivery car)

- Unearned revenues – these are revenues that your clients prepaid you first; you received the cash but you have not yet performed the work to merit the cash received. You will perform the work later and therefore you will record an unearned revenue as a liability – something that you owe and you will perform the services or provide the products to earn them later (e.g. deposit for an event, airline tickets, gift cards)

Accruals

Accruals are expenses or revenues where the services are used or provided or products have been consumed but no cash has been received nor that the events recorded in the books of the business

- Accrued expenses – these are expenses you have used or incurred but you have not yet paid in cash nor have you recorded them in your books (e.g. utilities)

- Accrued revenues – these are revenues you have earned but not yet received in cash or recorded them in your books

Let’s take a look at each of these and also some examples.

Key Takeaways: What to Adjust?

Adjusting Entries for Prepayments

Prepaid Expenses

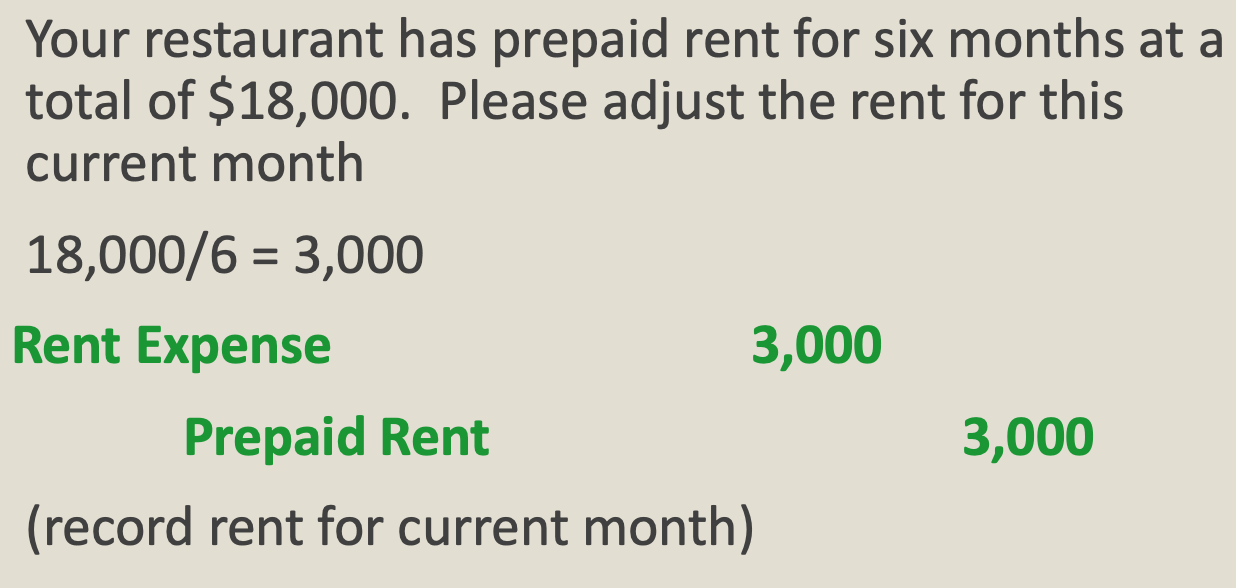

These are expenses that you paid already in cash and are recorded as assets before they are used/consumed (e.g. prepaid insurance, food/beverage inventory, rent, delivery car). These prepaids expires within the passage of time OR through use/consumption.

-

- When we pay (in the beginning):

- Debit the prepaid item (asset)

- Credit cash

- When we adjust (at the end of the accounting period):

- Debit the item expense

- Credit the prepaid item (asset)

- When we pay (in the beginning):

While regular prepaids are mostly for short-term or current assets, depreciation expense is a form of prepaids but for long-term assets. It recognizes the cost of a long-term asset (lasts more than 1 year) as it expires during its useful life (ex- building, equipment, furniture, cars). If you recall the Cost Principle from Modules 1&2, we are to keep the historical cost we paid for an asset (e, g., the van a hotel uses to transport guests to and from the airport) on the balance sheet. However, one knows that the value of the van always decreases. Thus, depreciation is used to reduce to the value of this asset. Depreciation is always an estimate.

There are a number of ways to estimate depreciation and the method we will learn here is called straight line method (to measure depreciation). The formula to estimate depreciation using the straight line method is:

Depreciation expense = (cost-salvage value)/estimated useful life.

We will then use a contra asset account know as “accumulated depreciation”, to offset against an asset account on the balance sheet so we will not violate the cost principle, to do the adjustment. Thus a depreciation adjustment will be to:

-

-

- Debit depreciation expense~ name of asset (at the end of the accounting period)

- Credit accumulated depreciation~ name of asset (at the end of the accounting period)

-

If we do not make an adjustment for prepaids, we will be saying that we have not used up any of our assets, and thus overstating our assets. At the same time, we will also be saying that we do not have any expenses, thus understating our expenses. Both are incorrect – and thus adjustment is needed.

Examples: Prepaid Rent and Depreciation

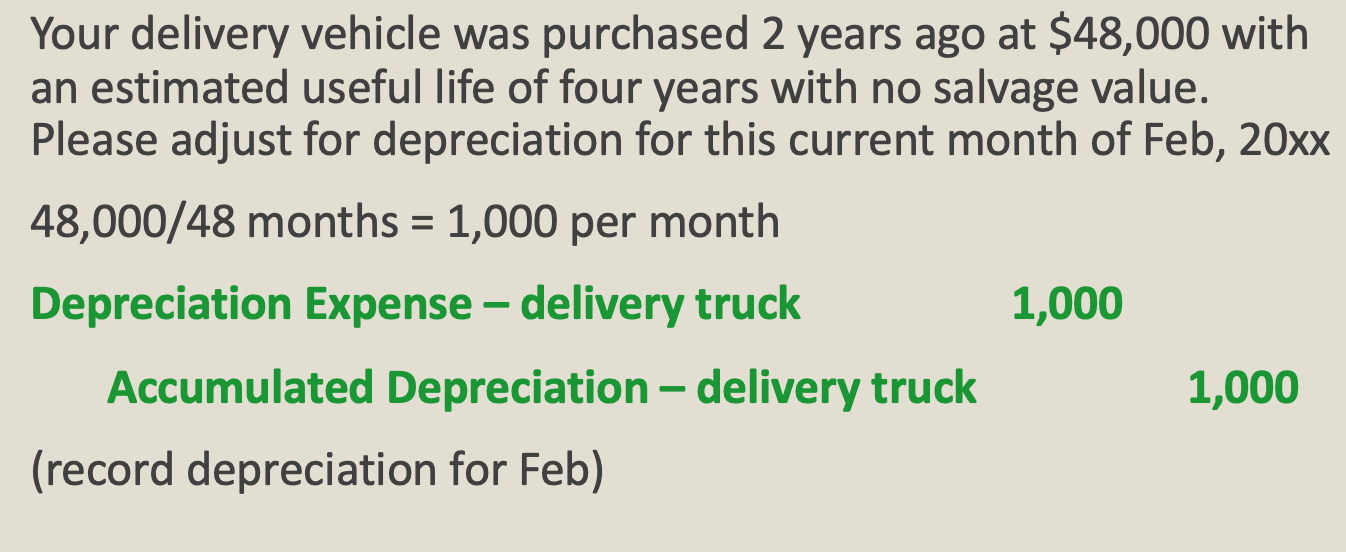

Unearned Revenues

As mentioned, these are revenues that your clients prepaid you first. Thus, this is also a for of prepaid – you received the cash but you have not done the work to merit the cash received. You will perform the work later and therefore you will recorded an unearned revenue as a liability when you receive the deposit (e.g. deposit for an event, airline tickets, gift cards). Revenue is then earned when we fulfill our commitment to the customer by providing them said good or service. So, when you were first paid this deposit, you cash increased but your liability (unearned revenue) also increased. And, increasing a liability is a credit. When you finally performed the service, you will now cancel this liability or debt that you owe by debiting unearned revenue. And, since you have performed the service, you have earned the money, so you will increase your revenue account by crediting revenue.

-

-

- When they pay (in the beginning)

- Debit cash

- Credit unearned revenues

- When we adjust (at the end of the accounting period)

- Debit unearned revenues

- Credit revenue

- When they pay (in the beginning)

-

If we do not make an adjustment for unearned revenues, we will be saying that we never earned the revenue that was prepaid to us before, thus understating our revenue. At the same time, we will also be stating we still owe our client the product or service, thus overstating our liabilities. Both are incorrect – and thus adjustment is needed.

Examples: Wedding Deposit

Adjusting Entries for Accruals

Accrued expenses are expenses you have used or incurred but you have not yet paid in cash nor have you recorded them in your books (e.g. utilities). In other words, you have used something (thus expenses) but you have not paid for it, so you owe (thus liabilities). Following the matching principle where we are supposed to match the revenues and expenses of the same period, we need to adjust for these expenses.

-

-

- When we adjust (at the end of the accounting period)

- Debit __xx___ expense

- Credit __xx___ payable

- If it is utilities, then it will be

- Debit Utilities Expenses

- Credit Utilities Payable

- If it is wages that we owe our employees, then it will be

- Debit Wages Expenses

- Credit Wages Payable

- When we adjust (at the end of the accounting period)

-

If we do not make an adjustment for accrual expenses, we will be saying that we never had that expenses thus understating our expenses. At the same time, we will also be stating that we do not owe someone that money, thus understating our liabilities. Both are incorrect – and thus adjustment is needed.

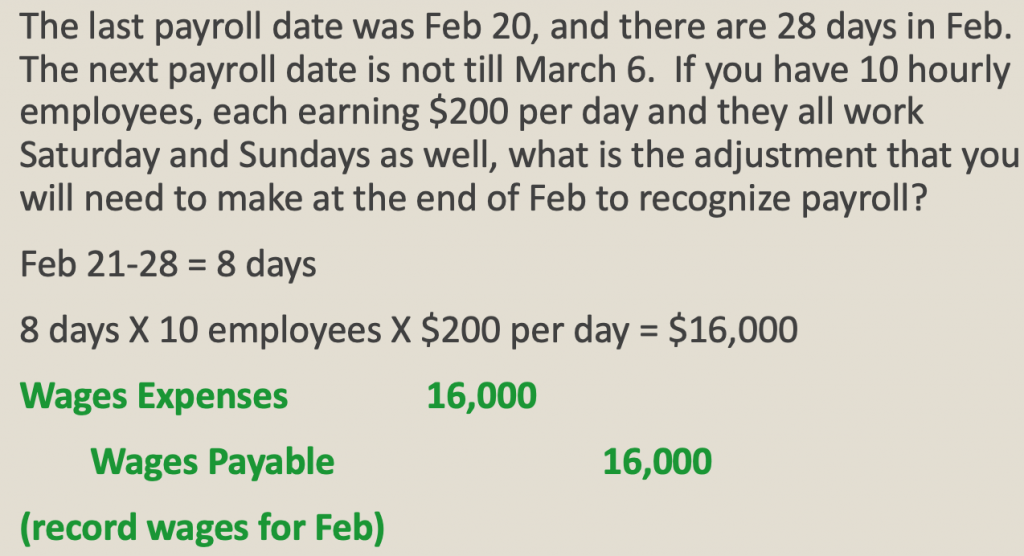

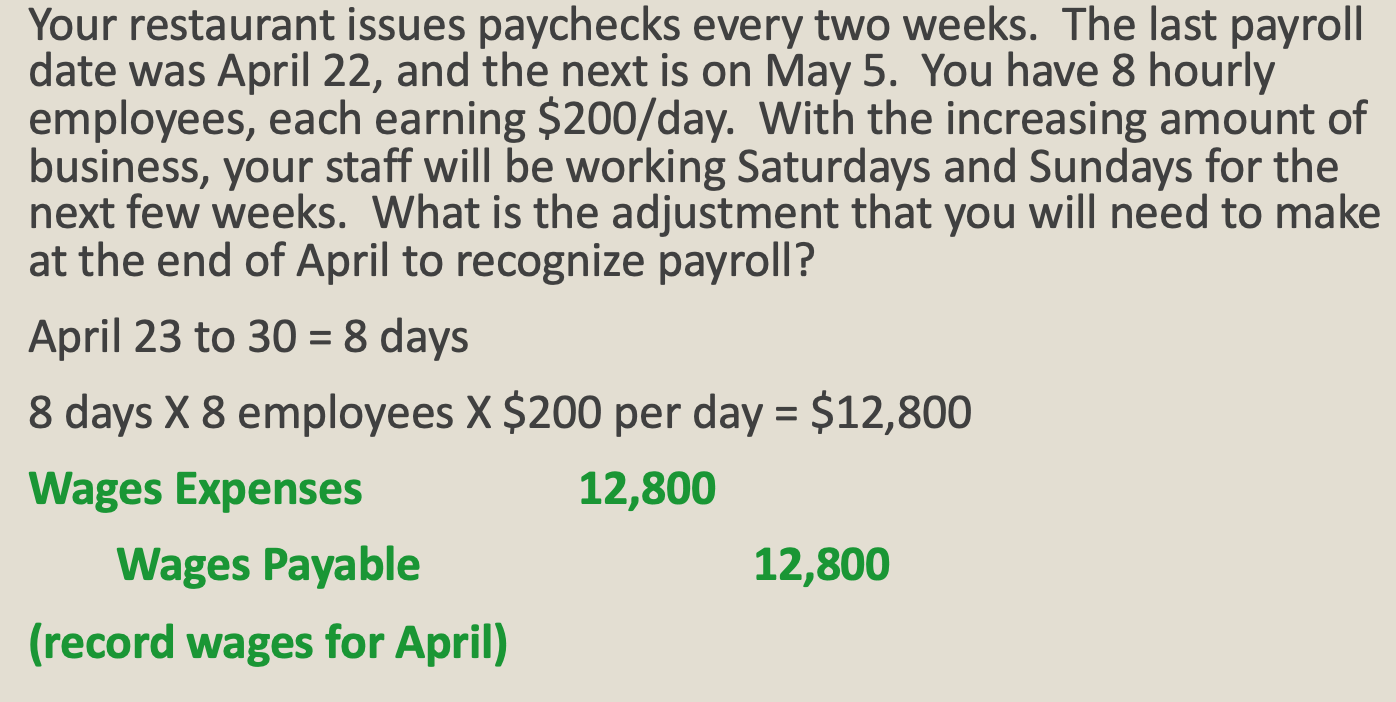

Examples: Accrual Expenses – We OWE

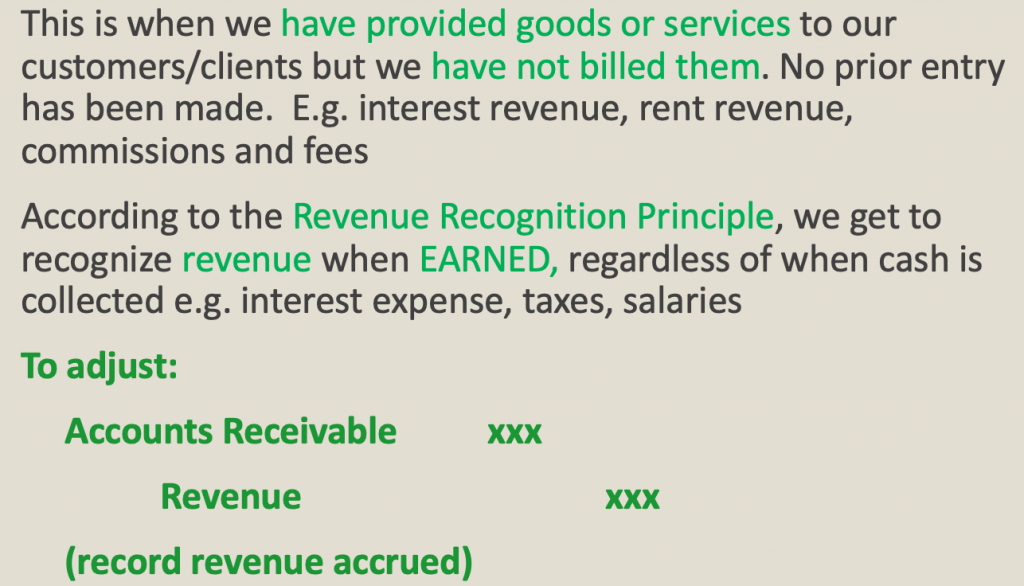

Accrued Revenues

Accrued revenues are revenues you have earned but not yet received in cash or recorded them in your books. This means no prior entry has been made. Your company could have earned some interest, or commissions, or fees; but none of these revenues were booked. Sometimes, these could be regular rooms revenue due to a contract that is not adjusted at the end of the accounting period. Thus, we have to bill such revenues by debiting accounts receivable and crediting the revenue account to show that we have earned the money but have not been paid and will receive the money later.

- When we adjust (at the end of the accounting period)

-

- Debit accounts receivable

- Credit revenue

-

If we do not make an adjustment for accrued revenue, we will be saying that we never earned the revenue thus understating our revenue. At the same time, we will also be stating that someone did not owe us that money, thus understating our assets in terms of accounts receivable. Both are incorrect – and thus adjustment is needed.

Examples: Accrual Revenues

Key Takeaways: How Adjustments Affect the Income Statement and Balance Sheet

Please note that each adjusting entry will affect a balance sheet account & an income statement account.

The Adjusted Trial Balance

In Step 5 of the accounting cycle, we perform all the adjustments. After all the adjustments are made, we will then do Step 6, the adjusted trial balance. This is not any different from the regular trial balance in Step 4, except that now we have more accounts added and that all events are included so the numbers that we will use to prepare the financial statements are the correct numbers. Thus, the adjusted trial balance is prepared after ALL adjusting journal entries have been journalized to the general journal and transferred to all the ledger accounts. Like the UNADJUSTED or regular trial balance, it proves the equality of total debits and credits. And, now, the account balances from the general ledger contain the data needed to complete all the financial statements.

Exercises: Examples on Adjustments with Answers – For You to Practice

For each question, indicate:

- what type of adjustment it is?

- what are the effect of the account balances before adjustment (i.e. if you do not make the adjustment)? and

- what should be your adjusting entry at the end of the month?

-

- Your restaurant does food inventory at the beginning of the month and starts off with $8,600 worth of food. Throughout the month, you purchase $29,850 worth of food inventory. At the end of the month, you do inventory again and count $9,320 worth of food inventory.

Type: Prepaid expense

Effect on accounts before the adjustments: assets overstated, expenses understated

Adjustment:

Food cost 29,130

Food inventory 29,130

How to Calculate: (8,600+29,850)-9,320= 29,130

-

- You borrow some money from a bank and sign a $7,200, three-month note payable on October 1, 20XX. The note requires interest at an annual rate of 24% and the entire interest is due at maturity. What is your adjusting entry to “accrue” for interest expense on October 31 after 1 month of this loan?

Type: Accrued expense

Effect on accounts before the adjustments: expenses understated, liabilities understated

Adjustment:

Interest expense 144

Interest payable 144

How to Calculate: 2% interest per month (24%÷12 months) $7,200 x 2%= 144

-

- In March, your catering company agrees to cater a wedding in June, and the couple gives you a $6,500 deposit in March to ensure your business.

Type: Unearned revenues

Effect on accounts before the adjustments: liabilities overstated, revenues understated

Adjustment:

Unearned revenue 6,500

Food revenue 6,500

How to Calculate: Given in question

-

- Performed services for spa clients. On August 31, $4,400 of such services was earned but not yet billed to the clients.

Type: Accrued revenues

Effect on accounts before the adjustments: assets understated, revenues understated

Adjustment:

Accounts receivable 4,400

Revenue 4,400

How to Calculate: Given in question

-

- You purchased kitchen equipment for $22,000 with an estimated useful life of 3 years and a salvage value of $4,000.

Type: Prepaid expense – Depreciation of long term asset

Effect on accounts before the adjustments: assets overstated, expenses understated

Adjustment:

Depreciation expense- kitchen equipment 500

Accumulated dep. – kitchen equipment. 500

How to Calculate: $22,000-$4,000=$18,000 $18,000 ÷ 36 months = $500 per month