1 Introduction to Hospitality Accounting

Learning Objectives

- Define accounting.

- Identify the users and uses of accounting.

- Understand why ethics is a fundamental business concept.

- Explain the meaning of generally accepted accounting principles, specifically the cost principle, monetary unit assumption, and the economic entity assumption.

- State the basic accounting equation, and explain the meaning of assets, liabilities and stockholders’ equity.

- Explain the accounting cycle and flow of information.

- Identify the various systems of accounting procedures used in the hospitality industry.

- Understand accounting and financial management in a hotel, foodservice operation and a club.

The Process of Accounting

Accounting can be defined as a process with four major steps:

- Identification – this is where economic events happen, and they are known as transactions. An economic event will affect a business and can also be measured

- Recording – record, classify, summarize the monetary effects of the transactions to the business

- Prepare – prepare the accounting work in the proper format so as to communicate with all the various users of the accounting information

- Analyze – interpret the results from all the accounting reports. This is an important step. A good manager needs to be able to understand and explain what the numbers mean to all interested parties such as the owners

A business can be organized in many ways, but the three most popular methods are sole proprietorship, partnership and corporation. Proprietorship or sole proprietorship means that the business is owned by one person. Generally, this is for a business where a small amount of capital is necessary to start the business. And, in this case, the owner or proprietor receives any profit or bears any loss and is personally liable for all debts the business incurs. A partnership is a business owned by two or more people. Each partner has unlimited personal liability for the debts of the partnership. There are other forms of partnership such as general partnership, limited partnership, or limited liability partnership which you will learn in other classes. Finally, a corporation is a separate legal entity with multiple ownership. These owners are also known as shareholders, and they have limited liability. If you buy a stock of Hilton, you are an owner of Hilton, and your liability stops at what you paid for that stock of Hilton. Ownership in a corporation can change without dissolving the corporation itself. In this case, you will simply sell your one share of Hilton stock to another person without affecting Hilton, the corporation. Therefore, a corporation has an unlimited life.

Identify the Users of Accounting

There are many people and organizations that need accounting information. Even non-profit organizations or churches have to document all their income and expenses! The users of accounting information can be roughly classified into two groups: Internal and External users. Internal users are people within the business organization while external users are people outside the business organization. Below are some of the examples of both internal and external users and why they may be interested in the accounting information.

Internal users

- Managers (Can we pay the bills? Can we give people raises? Can stockholders receive dividends?)

- Owners (How much money did we make last month? How much money can we make in the future?)

- Employees (Will the company be able to pay me? Will I get a raise? Will I have a job or even a promotion next year?)

- Supervisors (How am I doing in controlling my costs? Is my payroll in line? How are my employees performing? Are they up-selling?)

- Corporate level (What will our stock price be with the earnings reported? Will the stock price go up or down? Do we have the required cash to put in a bid for a new hotel?)

External Users

- Investors (Should I invest in this company? Should I sell my investment?)

- Creditors (Can this company pay back my loan?)

- Regulatory agencies such as the SEC (Has the company filed all the required reports?)

- Taxing agencies such as the IRS (How much tax should be reported by this company?)

Ethics is a Fundamental Business Concept

Ethics is the standard of conduct by which one’s actions are judged as right or wrong, honest or dishonest, fair or not fair. In working with any accounting information, ethics is of the utmost importance. You should never let any external force compromise your own integrity in reporting the truth. When in doubt, or when you encounter gray areas, always refer to the rules to which you must abide. Remember, all the users of accounting information are relying on you to report the correct information.

GAAP – Generally Accepted Accounting Principles

To guide you in preparing accounting information correctly, you have GAAP. GAAP stands for Generally Accepted Accounting Principles and is set or determined jointly by the Securities and Exchange Commission (SEC) & the Financial Accounting Standards Board (FASB). In this first module, you will be introduced to three principles. And, you will learn more in the subsequent modules.

Cost Principle. The cost principle dictates that assets are to be recorded at their historical cost. This means if you paid $1,000 for a piece of equipment, that cost of $1,000 will stay on your accounting records until that piece of equipment is disposed of. Some of you may have a question already – wouldn’t the value of the equipment be lower as it is being used? Absolutely, that is is known as depreciation and that will be covered in module 4. However, the original value will still remain as $1,000. You simply subtract the depreciation taken to obtain the lower “net book value”. Of course, if you were to buy a piece of land for $100,000 in 1990, in today’s world, that piece of land will be way more than $100,000. However, you are still to use that number on your financial statement until the land is sold. And at the time of sale, you can record and realize the gain.

Monetary Unit Assumption. This assumes that all business transactions can be expressed and measured in terms of some monetary unit. If your company is a US company, you will record the accounting in your books in USD. And, obviously, money is the common measurement of all economic activities and financial transactions around the world.

Economic Entity Principle. This principle states if you have a company, you need to keep your personal financial activities and your and business financial activities separate, as your business is its own economic entity. And, if you own a few restaurants, each restaurant is a unit of business, so each unit should have its own separate accounting work, and then the results of all the units can be aggregated at the end of the fiscal period to show the financial picture of the entire entity.

The Basic Accounting Equation

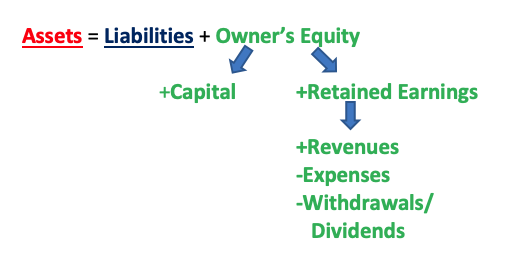

The basic accounting equation is A = L + OE **or any variation of that** such as A – L = OE, or A – OE = L. “A” stands for your assets, resources owned by the business that will have future economic benefit (e.g., cash, accounts receivable, land, inventory, the building itself, office supplies). “L” stands for liabilities, the existing debts & obligations of the business that have future claim on the economic benefits of the business (e.g., salaries and wages, accounts payable, long term debt) (hint: pretty much anything “payable” is a liability). Finally, “OE” stands for owner’s equity, and this is the ownership claim on the assets of the business.

OE is a bit more complicated than assets and liabilities in that it has two parts: paid in capital, and retained earnings. Paid in capital is the contribution to the business by the owners. This is the investment of the owners, that they “paid into” the business when they first started their business. Retained earnings is the money the owners put back (retained) in their business when the business made money. How do one get the number for retained earnings? There are three parts to this. Imagine you have a bakery and you sell wonderful cupcakes. On a daily basis, people come and buy cupcakes from you and they pay you – these are the revenues. Then, of course, to make the cupcakes and to open the door of your bakery to let people in to buy your cupcakes, you have to pay for a lot of things such as all the ingredients to make the cupcakes (flour, sugar, eggs, spices, etc.), wages to your employees, rent for the store, utilities, etc. – these are the expenses. Then, at the end, as the owner, you may want to take some money out from the business – why not? Isn’t this the reason people go into business, so they can make money, and then take the money out for their own personal use? This is known as withdrawals (if the business is a sole proprietorship or partnership) or dividends (if the business is a corporation).

Therefore, Revenues – Expenses = Profits or Loss; and Profits or Loss – Withdrawals or Dividends = Retained Earnings. In other words:

Revenues – Expenses – Withdrawals/Dividends = Retained Earnings

Thus, the relationship between assets, liabilities, owner’s equity, capital, retained earnings, revenues, expenses, and withdrawals/dividends can be expressed as follow:

Key Takeaways

Example: The Accounting Equation

You invested $10,000 into a new restaurant. The restaurant needs $15,000 for some new kitchen equipment and you must get a loan of $5,000 to pay for the rest of the equipment. What do these dollar amounts represent?

Answer:

$10,000 = Owner’s Equity

$15,000 = Assets

$5,000 = Liabilities

Assets = Liabilities + OE

$15,000 = $5,000 + $10,000

Example: Taking The Accounting Equation to the Next Step

Your hotel earned $60,000 in sales this month after paying $50,000 in expenses (from rooms expense to wages and everything in between). Luckily, you end up profiting $10,000! To keep all owners happy, you decide to pay them $4,000, leaving you with $6,000 to reinvest in your hotel. Label each amount.

Answer:

$60,000 = Revenues

$50,000 = Expenses

$10,000 = Profits (Revenues – Expenses = Profits)

$4,000 = Withdrawals

$6,000 = Retained Earnings (Profits – Withdrawals/Dividends = Retained Earnings)

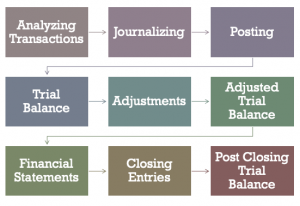

The Accounting Cycle

There are a total of 9 steps in the accounting cycle. In the next few modules, we will cover each step, one at a time.

- Analyzing transactions (analyze if a transaction is indeed a business transaction and what accounts this transaction would affect and by how much)

- Journalizing (done in a Journal which holds all the transactions that affect your business)

- Posting (transferring the information from the Journal to the Ledger accounts)

- Trial balance (adding up your debits and credits, proving that they should equal)

- Adjustments (adjust for any prepaids and accruals)

- Adjusted trial balance (same as the trial balance but includes all adjustments)

- Financial statements (Income Statement, Statement of Retained Earnings, Balance Sheet, and Statement of Cash Flows)

- Closing entries (closing all the temporary accounts at the end of an accounting period)

- Post closing trial balance (same as trial balance but will now only include the permanent accounts, i.e. accounts that were not closed during the closing process)

Systems of Accounts in the Hospitality Industry

In the hospitality business, there are four uniform systems of accounts. They are:

- The Uniform Systems of Accounts for the Lodging Industry (USALI)

- The Uniform Systems of Accounts for Restaurants (USAR)

- The Uniform Systems of Financial Reporting for Clubs (USFRC)

- The Uniform Systems of Financial Reporting for Spas (USFRS)

The USALI is the oldest and it is in its 11th edition. The group that is responsible for updating the USALI is the Financial Management Committee of the American Hotel & Lodging Association (AHLA), and the copyright is owned by the Hospitality Financial and Technology Professionals (HFTP). [If you are interested in the financial or technological part of the hospitality industry (or think you might be), then the Hospitality Financial and Technology Professionals organization is for you! The Hilton College at UH has our very own Cougar Chapter of HFTP available for you to join. HFTP lets you network with financial and technology professional in our industry through monthly dinners at hotels, clubs, etc.]. The FMC is currently meeting to begin work on the 12th edition.

Owned by the National Restaurant Association, the USAR is the next most senior publication currently in its 8th edition. The USFRC for clubs is owned by the Club Managers Association of America is its 7th edition, while the USFRS owned by ISPA is still in its first edition. As changes occur in accounting regulations and/or business practices in these segments, these publications are updated as needed.

Accounting and Financial Management in Hotels, Foodservices, and Clubs

Between the three segments of hotels, foodservice, and clubs, the accounting/finance office is probably most complicated for hotels. Of course, this all depends on the size of hotels, or clubs, or if a restaurant is a single unit restaurant or part of a conglomerate. In a medium size hotel, there will normally be a controller or a director of finance and accounting (DoFA) who leads all the account efforts of the establishments. In a big hotel of over 1,000 rooms, connected to a convention center, with its own meeting space, you may find under a DoFA a senior assistant DoFA, assistant DoFA, accounts payable clerks, accounts receivable clerks, general cashier, paymaster, night and day auditors, and credit manager. For some, the director of purchasing or director of information technology may also report to the DoFA, depending on the size of the operation.

For clubs, since most billings are done at the end of the month rather than a daily basis, the accounting department is normally not as large as a hotel. The accounts you will see in a club will also be different. For example, there will be initiation fees or membership dues that are normally not found in a hotel, unless a hotel also has a spa or health club that sells membership to local residents. For restaurants, the emphasis in accounting is normally found in cost controls in food cost, beverage costs, and payroll costs.

Facts about Our Industry

.

.

Source: American Hotel & Lodging Association

Source: