2 Accounting Principles

Learning Objectives

- Discuss the qualitative characteristics of accounting information and elements of financial statements.

- Identify the basic assumptions, principles, and constraints of accounting.

- Analyze the effects of business transactions on the basic accounting equation.

- Understand the four financial statements and how they are prepared.

Qualitative Characteristics of Accounting Information and Elements of Financial Statements

The four items of the FASB’s conceptual framework are:

- Objectives of financial reporting

- Qualitative characteristics of accounting information

- Operating guidelines

- Elements of financial statements

To begin, the objectives of financial reporting are to ensure that: (1) the accounting information is useful in making investment and credit decisions, (2) the financial reports are helpful in assessing future cash flows, and (3) the assets, liabilities, and changes in those resources are clearly identified.

All accounting information also should contain four specific qualitative characteristics. First – “relevance”. Accounting information should be completed in a timely manner so that it can make a difference in decision making. For example, if an accountant takes a couple of months to prepare any month-end statement, then if there are issues with the operation, the financial results or reports will not be available till months later and thus will not be useful to the operation. Second – “reliability”. The accounting information should be reliable in that it is free of error and free of bias. Third – “comparability”. This means the information of one business can be compared to other enterprises (your competition). This also means a business can compare itself from one accounting periods to another. This is why there are various uniform systems of accounts in the hospitality industry, as discussed at the end of Module 1. If all businesses follow one way to perform their accounting work, classifying the expenses and revenues in the same way, then it will be very easy for anyone to compare one business unit to another. Finally – “consistency”. A company should use the same accounting principles from one year/period to the next. This does not mean the one cannot change how depreciation is to be recorded or how inventory is being evaluated. However, there needs to be justification for the change and the business should not be using method A in January and then switch to method B in February, then to C in March and back to B in April, etc.

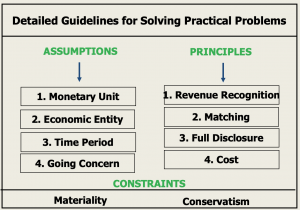

Next, operating guidelines. Sometimes you see these guidelines referred to as assumptions, other times, they may be known as principles or constraints, but just note that they are all part of GAAP, and they are all guidelines for you to prepare your accounting information. The elements of financial statements will be discussed later in this module.

Guideline: Assumptions, Principles, and Constraints of Accounting

In Module 1, we looked at the monetary unit assumption and the economic entity assumption. Two more assumptions mentioned here are time period and going concern. The time period assumption basically says that the economic life of a business can be divided into equal time periods such as weeks, months, years, so we can tabulate the financial results at the end of each period. The word equal is used loosely as not all months have the same number of days. Going concern assumes that the business will continue in operation to carry out its objectives. You are assuming that your business will continue into the foreseeable future.

Besides the four assumptions, there are also four principles. The cost principle was discussed in Module 1 so we will start with the second principle – the revenue recognition principle. This principle states that a business can only recognize revenue in the accounting period it is “earned”. If the revenue has not been earned yet (such as you signed a contract in February to cater a wedding party in December and you received a deposit in February), that is not revenue because you have not performed any service to earn the money as yet! Therefore, the matching principles follows and says expenses are recognized in the accounting period in which efforts are made to generate revenue. In other words, you match revenues and expenses of the same period. Finally, full disclosure. If there are circumstances and events that will make a difference in the accounting results of a business, the business has the duty to disclose such information. For example, if someone files a lawsuit against your restaurant, and it is significant enough to make a difference in your books should the plaintiff wins, then the people reading your books/statements/financial information need to know about it, and you have to disclose the lawsuit.

As for constraints, there are two. The materiality constraint means if an item’s impact on a firm’s overall financial condition and operations is material, then, it needs to be reported. For instance, buying a $10 trash can probably isn’t very “material” in a business, so it doesn’t need its own line-item as an account but can be included in perhaps “office supplies” or under “miscellaneous”. For the most part, it simply means an accounting standard can be ignored if the net impact of doing so has such a small impact on the financial statements that a user of the accounting information would not be misled. As for conservatism, this basically means when in doubt, choose the method that would least likely overstate assets and income. In other words, be conservative!

Know these 10 operating guidelines as you will see them throughout this course and you use them to guide how you complete your accounting work:

Key Takeaways: GAAP Guidelines

Effects of Business Transactions on the Accounting Equation

Recall that the accounting equation is A=L+OE, so any transaction that affects a business needs to be measured and then analyzed to see what accounts that transaction will affect, and in turn, how the accounting equation will change. Transactions are economic events of an enterprise/business that will be recorded into the “books” or accounting information of a business. These events can happen externally, involving the company and a third party or internally, concerning individuals within the company. Paying an invoice to a supplier in an external transaction whereas paying payroll is an internal transaction. Regardless of whether the transaction is internal or external, the equality of the accounting equation must always be preserved!

Examples: Every transaction is NOT a business transaction

A celebrity posted on her social media that she loves your restaurant. Is this a business transaction? No! Firstly, how does this affect your business? Are you sure you will see more revenue? Or if she is a celebrity that people do not like, would that hurt your business? Nothing has happened to your sales yet, so no revenues can be recorded. Secondly, how are you going to measure the event? Is that a positive $1,000, or $500, or $780? Thus, unless a transaction actually occurred and that you can measure the impact, this celebrity posting is NOT a business transaction.

Transaction Analysis

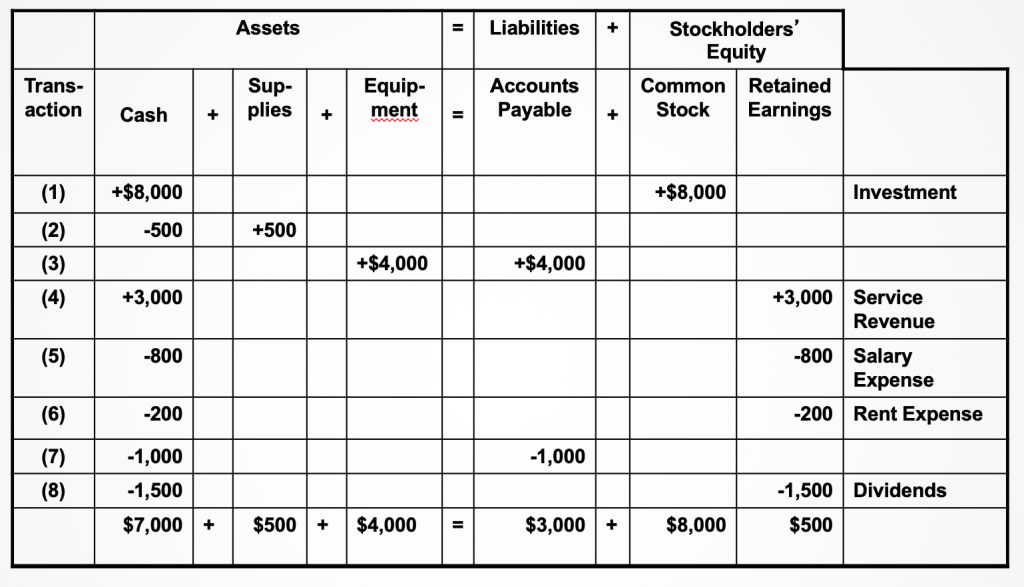

Let us do an example of transaction analysis. But first, please go back to Module 1 to review the various components of the accounting equation and the different accounts that make up those components, such as cash is an asset, equipment is an asset, accounts payable is a liability, anything purchased “on credit” would be a liability, etc. Know the accounts, know the components. In this case, Julia Jansen is a hospitality consultant and she opens her consulting company in September. There are 8 transactions listed. Every business transaction affects at least two accounts, some may affect three or more accounts. In performing a transaction analysis, you need to figure out what accounts are affected and by how much.

Examples: Transaction Analysis

Julia Jansen opened and incorporated a hospitality consulting firm during the month of September and provided you with the following data

Prepare the tabular summary for the transactions above

Answer:

In this example, all eight transactions are business transactions that affect Julia’s consulting business. Let’s look at some of them. The first one is when she invested $8,000 of her money into the business and incorporated the business. Remember one of the guidelines is economic entity. Although the $8,000 is Julia’s money, once she invested the money into the business, the $8,000 belongs to the business as “common stocks” and also as “cash”. So, with this investment, Julia now has cash in the business so she can go buy the things she will need to operate her business. Julia is an entity; her business is another entity. So, recording this $8,000, we are also observing the economic entity principle. Now, while you are not required to identify which guideline you are following when you analyze each transaction, you ARE actually following them. Anyhow, for this transaction, Julia’s business saw an increase of $8,000 in cash and an increase of $8,000 as owner’s investment in terms of common stock. Since both sides of the equation increased by $8,000, the equation is balanced.

Key Takeaways: Transactions

Every business transaction affects at least two accounts, some may affect three or more accounts. And, after each transaction is recorded, the accounting equation is always balanced.

Now that Julia had money in the business, she needed some supplies. So, she purchased $500 of supplies for cash. Do note that accounting sometimes do not follow the exact rules of English. One would normally say she purchased supplies “with” cash, but please do not let the prepositions or words bother you. Since it said cash, that meant Julia paid $500 in cash in exchange for the supplies she purchased. So, her supplies account was zero but now is worth $500. Her cash account, on the other hand, was $8,000; but after the purchase, it is now $7,500. A running total is not needed at this point. This tabular form of presenting the material is more to provide a visual for you, so you can see:

- the effects of a transaction on the accounting equation

- the accounting equation is always in balance, and

- the balance can be achieved by:

- increasing at least one account on both sides of the equation

- decreasing at least one account on both sides of the equation

- increasing and decreasing the same amounts on accounts on the same side of the equation

To assist you in reviewing and understanding transaction analysis better, a video is provided for you in Blackboard under Module 2. Please view “Summary Video (2)” under Module 2. Learning the different components just takes practice and repetition! You can do it!

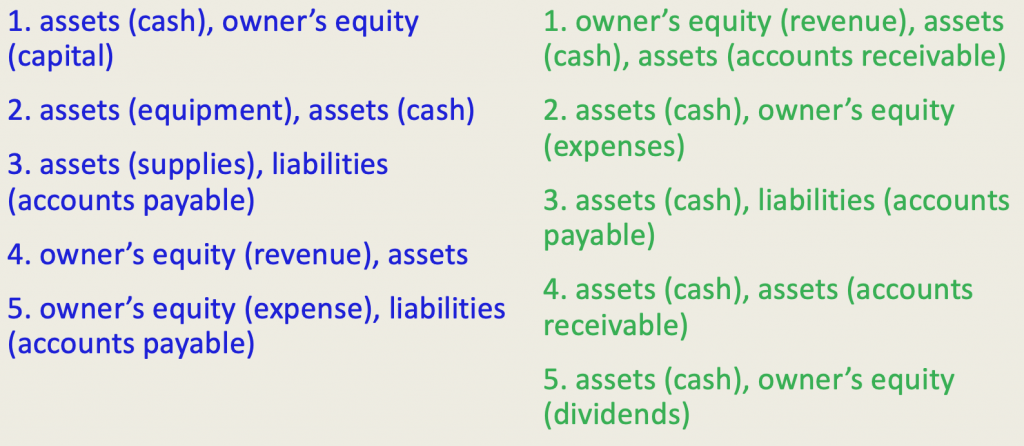

Exercises: Transaction Analysis

Which components of the accounting equation (assets, liabilities, owner’s equity) and what specific accounts (cash, supplies, accounts payable) are affected by the following transactions?

Answer:

Elements of The Four Financial Statements

Now that we have analyzed the transactions that affect a business using the tabular form and that you see the balance of each account, you are now ready to put these pieces of information into statement form to communicate with the users of your accounting information. The four financial statements discussed in this course are:

- Income Statement

- Retained Earnings Statement

- Balance Sheet

- Statement of Cash Flows

These statements are to be prepared in this specific order. Each will also start with a 3-line title to include the name of the business, the name of the statement, and the specific date/or period covered.

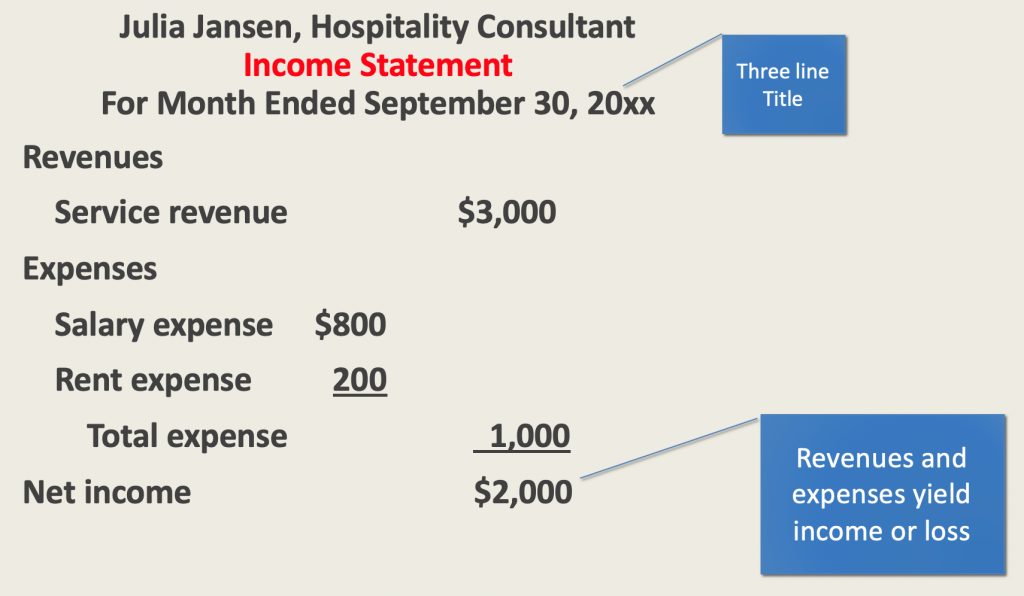

First, the Income Statement . The Income Statement is a “period” statement, covering a specific period such as a week, a month, a quarter, or a year. It shows only revenues and expenses (and their components such as rooms revenue, wages expense, etc), resulting in either a net income or net loss.

Examples: An Income Statement

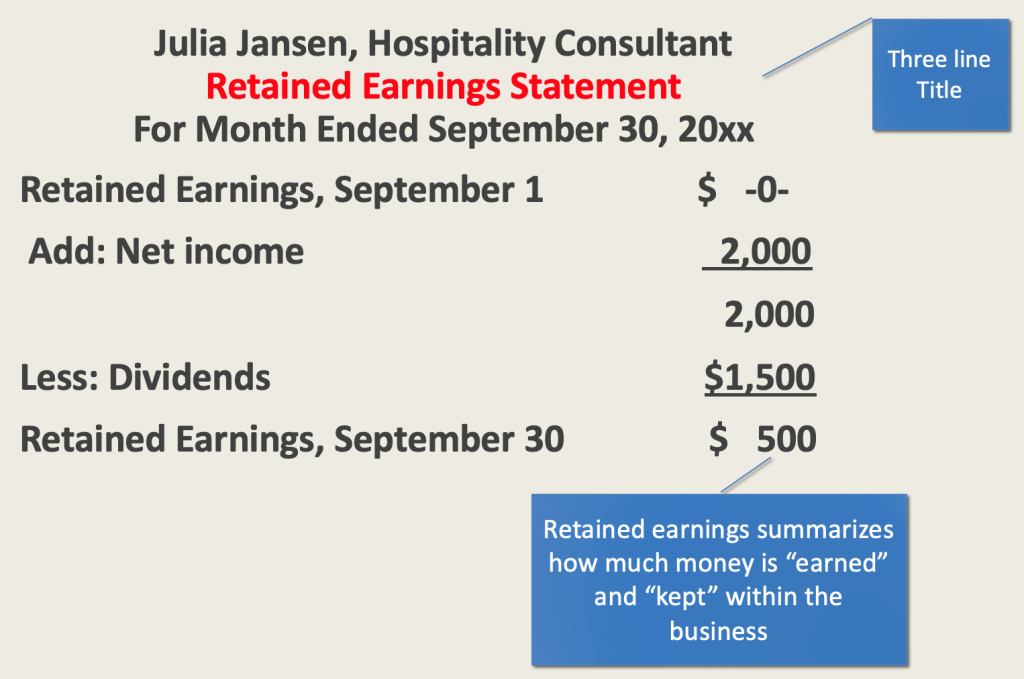

The Statement of Retained Earnings or the Retained Earnings Statement is also a “period” statement measuring the earnings, distribution, and the amount kept back in the business for the business to grow. It is also the easiest and shortest statement to compile. You will start with how much money was in the retained earnings account at the beginning of the period, adding to it how much was earned (hopefully adding net income and not subtracting net loss), and the amount distributed or paid out to the owners/investors, resulting the total amount being kept within the business. In this particular example, since Julia just opened the business, there was no balance in the retained earnings at the beginning of September. She earned $2,000, paid $1,500 in dividends and kept $500 in the business.

By now, you might have figured out why the Income Statement has to be prepared first. Without the net income or net loss from the Income Statement, you will not be able to complete the Statement of Retained Earnings.

Examples: A Statement of Retained Earnings

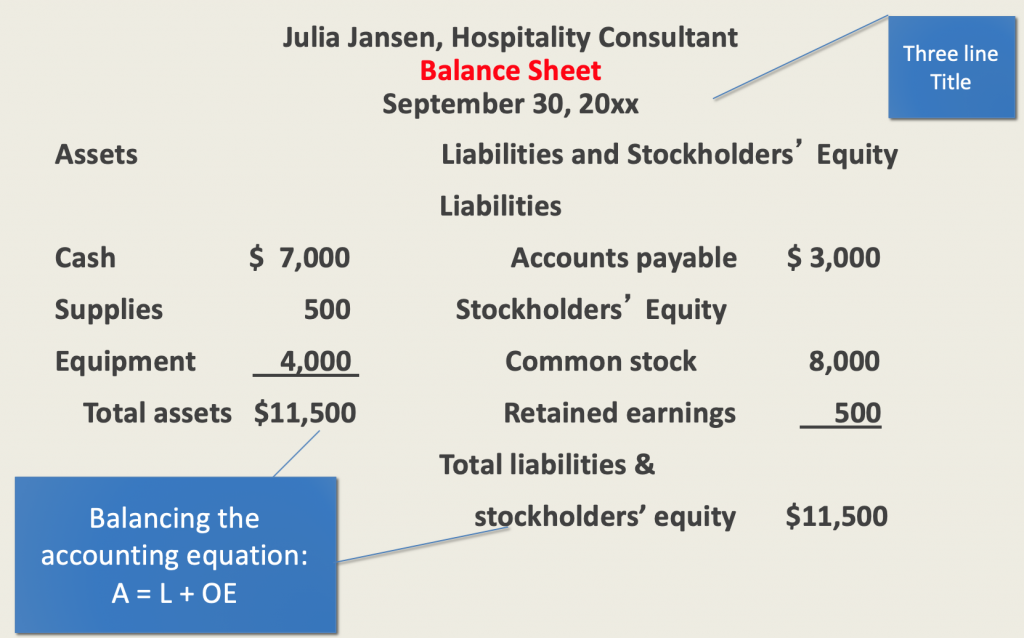

Unlike the previous two statements, the Balance Sheet is a “dated” statement. At the end of any accounting period, whatever that date may be, that will be the day you will compile for Balance Sheet. The Balance Sheet, as its name suggests, balances your accounting equation (A = L + OE), where total assets must equal total liabilities plus owner’s equity. There are two ways to show the accounts. The one included here, showing the accounts side by side is called the account form, where assets are on one side and liabilities and owners’ equity are on the other side. The second option is the report form where you will start listing all the assets and totaled them. And then below the total assets, you will list all the L+OE accounts. Regardless of methods, total assets should always equal to total liabilities and owners’ equity added together. You might also see that without the ending or new balance of the retained earnings account of $500, the assets WILL NOT balance to the total liabilities and owners’ equity. This is another reason why you will need to complete the Income Statement first, then the Statement of Retained Earnings, and finally the Balance Sheet.

Examples: A Balance Sheet

The Statement of Cash Flows, our fourth statement, is also a period statement. It measures how cash flows through your business, either through operating, investing, or financing activities. This will be covered in detail in Module 6.

Obviously, the example of Julia Jansen used here only has 8 transactions and a handful of accounts. In real life, you will have many more transactions and accounts, and thus the tabular form will not be the proper way to analyze your data. In the next module, you will learn more about individual accounts, journals, and ledgers, and how they are used to record information for a business.