5 Completion of the Accounting Cycle

- Prepare a worksheet.

- Explain the process of closing the books.

- Describe the content and the purpose of a post-closing trial balance.

- Explain the approaches to preparing correcting entries.

The Worksheet

The worksheet is a multiple-column form that may be used in the adjustment process and in preparing financial statements. It is NOT a permanent accounting record, journal nor ledger. It is also NOT part of the accounting cycle. But it IS a very good working tool for an accountant. It organizes all the financial data for you at the end of an accounting period and also shows if you have a profit or loss. So, it is used by accountants though it is not a report distributed to other users for decision making purposes.

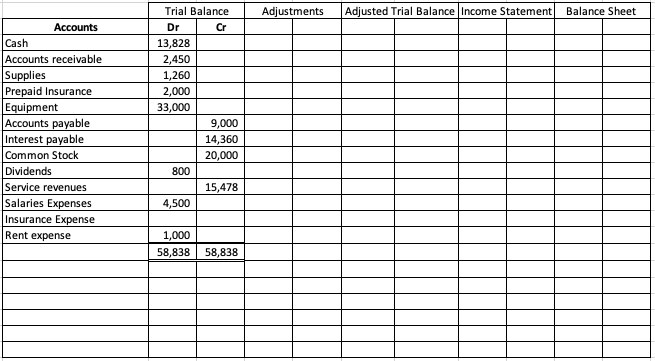

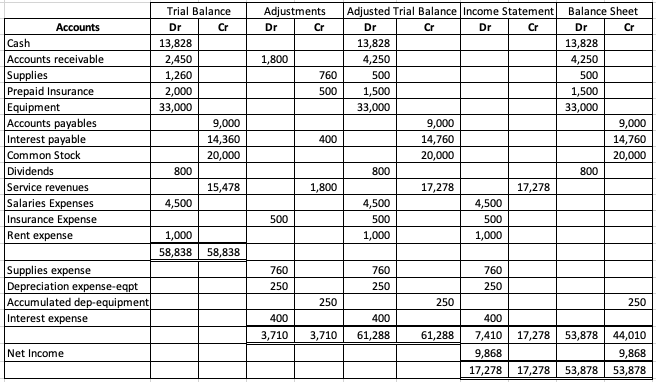

A worksheet has five sets of columns of debits and credits. They are the Trial Balance, Adjustments, Adjusted Trial Balance, Income Statement, and Balance Sheet. The accounts are also listed in the proper order of A, L, C, W, R, and E. In the example below, you can see that the accounts are listed in that order. In addition, other accounts, as needed can also be added to a worksheet in the bottom part. When a worksheet is completed for one accounting cycle, the accounts (old and newly added) will be place in the right order, ready for the worksheet for the next month. So, this in the example, you can see that four new accounts are added for this month.

To prepare a worksheet, you will start will the Trial Balance. From previous modules, you may recall that the trial balance is a list of accounts and their balances (debits or credits) on a specific date in the order of A, L, C, W, R, and E. Thus, to complete this column, you will simply enter the balances of each account here, in the correct order of A, L, C, W, R, and E, and total the debit and credit columns.

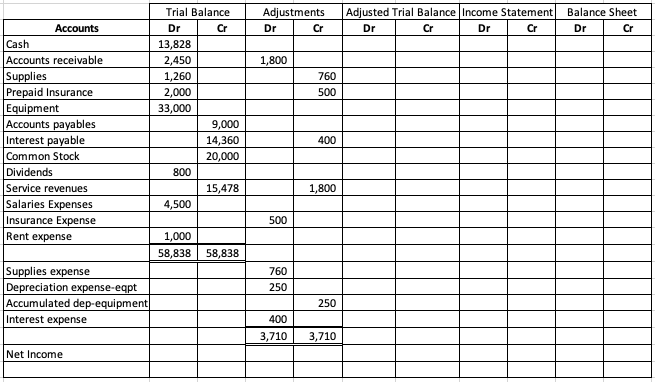

Then, the debits and credits of each of the adjusting entries will now be placed in the Adjustments columns, and totaled.

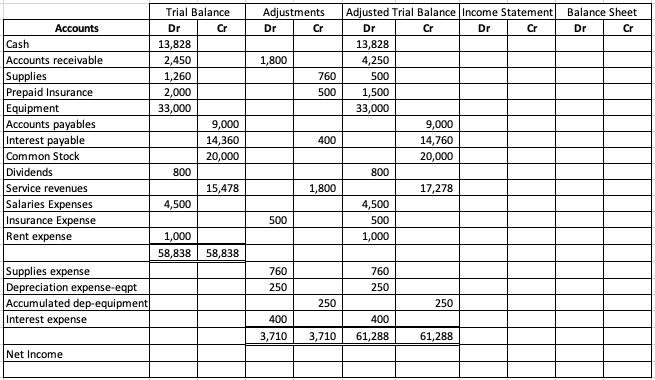

Once the adjustments are entered, you can now completed the Adjusted Trial Balance Columns by adding and subtracting the debits and credits of each account. In the example, the first account is cash. There is no adjustments to the cash account – there will NEVER be any. Think this way – adjustments are prepaids and accruals. If they are prepaids, cash has changed hands before, so there will not be any adjustments regarding the cash account. And, if the adjustments are accruals, the cash has not changed hands as yet, so again there will not be any adjustments regarding the cash account. So, remember, the cash account is never used in adjustments, and thus the balance in the trial balance should be the same as the balance in the adjusted trial balance.

Key Takeaways: Cash and Adjustments

The cash account is NEVER used in adjustments.

The second account in the example is accounts receivable. Here, we had a debit balance from the trial balance as $2,450. There is also an adjustment made to this account of a debit of $1,800. If they are both debits, or they are both credits, we should add them together. In this case, a total of $4,250 is now placed in the debit column of the adjustment trial balance.

If for you some reason the balance in the trial balance is a debit, but the adjustment is a credit entry, then you will subtract the two and place the balance in the adjusted trial balance column accordingly. In the example below, supplies started with a debit balance of $1,260. However, $760 was used and therefore the account is credited to decrease the amount used. This therefore results in a new balance of $500 ($1,260- $760) in the balance column of the adjusted trial balance. You will do that for every account until all the new balances are calculated, and then you totaled the two columns. If your work is correct, then the debits should again equal to the credits.

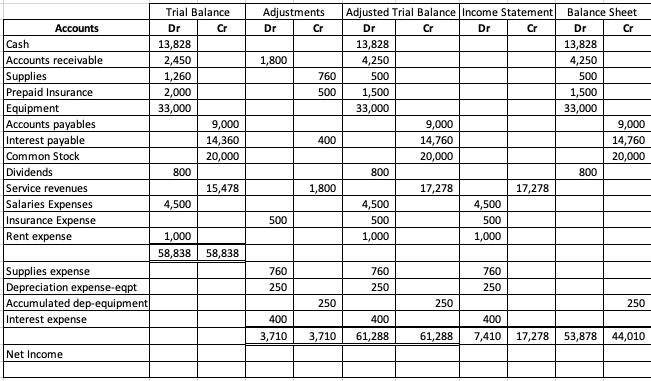

Now that you have the correct numbers in the adjusted trial balance columns, the last two columns should be simple, because you are simply relocating each of the balance in the adjusted trial balance columns to either the Income Statement columns or the Balance Sheet columns. Again, you may recall, of all the accounts A, L, C, W, R, and E, the accounts for the Income Statement are only R and E – Revenues and Expenses. You may also recall that revenues have credit balances and expenses have debit balances. So, when you relocate the balances from the adjusted trial balance columns to the income statement columns, be extra careful and place the balances in the proper columns. Another hint is that since most of the accounts are in the order of A, L, C, W, R, and E, you can identify the R and E very easily as they are at the bottom of the list. However, DO NOT forget the new accounts that you just added for in the adjustments columns.

Using the same logic, now transfer the balances of the rest of the accounts (A, L, C, and W) to the Balance Sheet columns, then totaled the columns.

You will find that the debits and credits of the Income Statement columns and the Balance Sheet columns do not match? Why? Did we do something wrong? No, you are good! In fact, you want them not to be the same and you want the credit total of the Income Statement to be greater than the debit total; and for the Balance sheet, you want the opposite, that the debit total of the Balance Sheet to be greater than the credit total.

Well, why are you in business? To make a profit, right? If you look at the Income Statement columns and the accounts, the credit total is the total of all the revenues and the debit total is the total of all the expenses! So of course you want your revenues to be more than the expenses! For the Balance Sheet, where do you find the capital account or retained earnings? They are credit balance accounts. And, if you recall from Module 2 when we looked at the Statement of Retained Earnings, we add the net income we make to the Retained Earnings account. Therefore, if a business makes money, the net income will be added to the “credit” side and thus for now, before we figure out the net income or net loss, the totals of the debits and credits of the Income Statement and Balance Sheet do not balance out!

Take a look at the last worksheet (the completed one). If you see the balancing number on the outsides (debit for the income stmt. & credit for the balance sheet), this mean you make money and you have a net income. If unfortunately you balancing number is on the inside (credit for the income stmt. & debit for the balance sheet), then you have a net loss. In our example, the total revenues are $17,278, and total expenses are $7,410. Therefore, the net income is $9,868. The difference in the Balance Sheet columns should also be the same so that you can place the $9,868 in the credit column of the Balance Sheet for it to be added to the retained earnings when you prepare the financial statements.

Examples: How to Complete a Worksheet

Closing the Books

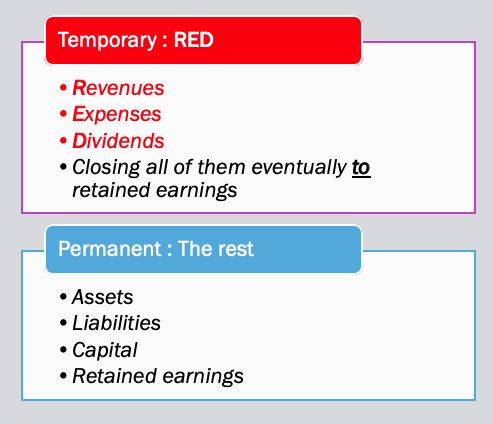

Now that you have completed the worksheet, you have all you need to close the books. For now, we will skip the steps of preparing the financial statements as we want to give that part the proper attention it needs. We will have an entire module in module 6 to look at this. In other words, for now, you are ready for the last two steps of the accounting cycle – the closing entries and the post-closing trial balance. While accounts are divided into A, L, C, W (also D for dividends), R and E, we can group them into two types of accounts:

- Temporary (or “nominal”) – relate ONLY to a given accounting period and thus they will be closed at the end of an accounting period, or zeroed out.

- Permanent (or “real”) – relate to one or more future accounting periods. These are NOT closed.

Thus, at the end of an accounting period, the accounts are either closed or not closed, and are prepared for the next period.

Why do revenues, expenses, and dividends need to be closed and others do not? Remember, accounting is simply recording and tallying how much is in each account. Let’s say you are the manager of a hotel. Don’t you want to know the revenues of any specific day or a specific period and not a carrying a grand total of revenues since your hotel opened years ago? For those of you who work in restaurants, and especially the evening shift, don’t you “close out” the night by running a report in your point of sales system so that all the revenues are tallied correctly, so that when the morning shift comes in for breakfast the next day, they will start their revenues from zero again? Well, the same reasoning applies here.

However permanent accounts are not closed or are not zeroed out. Their balances will be carried over to the next accounting period. Think about your personal bank account. For example, say today is 12/31, last day of the year. And right before 12 midnight, you have $1,000 in your bank account. Would you like to see your $1,000 magically disappear and your bank balance becomes “$0.00” just because we are starting a new year for 1/1 when the clock strikes midnight? By the same token, if I owe you $100 on 12/31, I don’t think you would like to just simply forgive my debt to you when 1/1 comes around and zero out your $100 accounts receivable balance. So, all the assets, liabilities, and capital accounts remain intact and the balances will be carried over to the next accounting period.

Key Takeaways: The RED Accounts – Closed Them to Retained Earning

Preparing Closing Entries

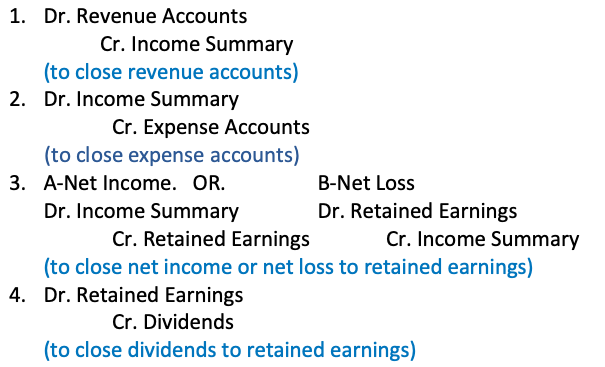

Now that you know the RED accounts are those that need to be closed, let’s see how this is being carried out. Again, the idea of closing is to zero out those accounts so that when the next accounting cycle begins, you can start tallying again how much money you take in as revenues, how much you spend in expenses, and how much you pay your owners and shareholders in withdrawals and dividends.

In the closing process, you will now learn a new account “Income Summary”. As its name suggests, it “summarizes the income” for the business. You will only see this account during the closing process and once the accounts are closed, the income summary account is gone as well. The goal in closing is to make the balances in R, E, and D become zero. In other words, whatever balances those accounts have, all you need to do is to just do the exact opposite. For example, revenues are credit balance accounts. If you have $600 in revenues, to close it, you just need to DEBIT revenues by $600. Closing entries, just like any entries, such as transactions or adjustments, are journalized to the General Journal and then posted to the General Ledger.

When doing the closing entries, you need to CLOSE the RED accounts, so remember the 4 sets of closing entries:

- close revenues into income summary

- close expenses into income summary

- close income summary into retained earnings

- close dividends to retained earnings

In the Key Takeaways box below, you can see the four entries. Always remember the normal balance, then do the opposite. The first step is to close all the revenue accounts. You will have to list each revenue account individually if there are more than one revenue account. Since revenues have normal credit balances, to close them, you simply debit all of them, one by one, and then credit the total to income summary. Now, that is when your worksheet becomes your best friend. Look at the Income Statement columns of your worksheet. In our example, there is only one revenue – Service Revenues. So, to close revenues, you need to do the following:

Service Revenues 17,278

Income Summary 17,278

(to close revenue account)

The second step is to close all the expense accounts and again you will have to list them individually. Take a look at the worksheet, they are listed one by one for you in the debit column of your Income Statement! So, you simply list them one by one in the closing entry. Now, since expenses have normal debit balances, to close them, you will need to credit all of them, one by one, and the debit the total to income summary. And since in a journal entry, you always need to enter the debit first, so you will debit income summary first, and then credit all the expense account one by one. Well, how much should you debit income summary for? Take a look at your worksheet – all the expenses totaled to $7,410!! So, there is your debit. And that is why you would love your worksheet as you have done all the work and have calculated all the answers already. So, again, to close expenses, you need to:

Income Summary 7,410

Salaries Expense 4,500

Insurance Expense 500

Rent Expense 1,000

Supplies Expense 750

Depreciation Exp. – Equipment 250

Interest Expense 400

(to close expense accounts)

The third step is hopefully closing a net income rather than a net loss into retained earnings. Since there is either a net income or a net loss, depending on the profitability of that particular accounting cycle, you will use one of the following. In steps 1 and 2, we close all the revenues and expenses into income summary. In other words, the Income Summary account now summaries the income of the business. So, if the business makes a profit, the Income Summary should have a credit balance. Thus to close it, you will debit Income Summary and credit retained earnings. And this makes sense because increasing retained earnings is to credit that account, and vice versa.

Net Income Net Loss

Income Summary 9,868 Retained Earnings

Retained Earnings 9,868 Income Summary

(to close net income or net loss to retained earnings)

Finally, you are to close dividends to retained earnings as well. Dividends is a debit balance account, so to close it, you will credit dividends. And since every entry has a debit and a credit and you have credited dividends already, the retained earnings account has to be debited. Do recall in Module 2 when you first looked at the Statement of Retained Earnings that withdrawals and dividends are taken out of the retained earnings account. Again, this checks out too since retained earnings is a credit balance account so to decrease it (paying dividends will lower the amount the owners have in the business), you will debit retained earnings.

Retained Earnings 800

Dividends 800

(to close dividends to retained earnings)

Key Takeaways: The Four Closing Entries

The Post-closing Trial Balance

You are almost there – the last step of the accounting cycle is the Post-closing Trial Balance. ANOTHER Trial Balance? Yes. You just did your closing entries in the journal, now, these numbers have to posted to the ledger accounts. And just to make sure everything is correct so we can start the next accounting cycle, we just need to do a quick trial balance again. And since this is done AFTER the closing entries, that is why it is called “Post-closing” Trial Balance – prepared after all closing entries have been journalized and posted. This does help to prove the equality of the permanent account balances that are carried forward into the next accounting period! But, what about the temporary account balances? Remember, they have been closed, so they are all zeros. Therefore, in a post-closing trial balance, all you should see are the assets, liabilities, capital (and retained earnings) accounts. No more revenues, expenses, or dividend. This trial balance should be very short!

Adjustment and Correcting Entries

So, you have completed every step of the accounting cycle and everything are nicely balanced. But what if you find something wrong? Well, of course we will then need to correct it. There are differences between CORRECTing entries and ADJUSTing entries:

- Adjusting entries happen all the time in the normal course of accounting. Correcting entries are unnecessary if the records are free of errors

- Adjustments are posted at the end of accounting periods. Correcting entries are posted as soon as errors are discovered

- Adjustments affect one BS account and one IS account. Correcting entries can affect any combination of accounts

Now that you have mastered the basics of accounting, we can now dive deeper into the financial statements!